As posted by Thomson Reuters on 12/22/17 On 12/22/17, President Trump signed into law H.R. 1, the “Tax Cuts and Jobs Act,” a sweeping tax reform law that will entirely change the tax landscape. The legislation reflects the largest major tax reform in over three decades. This Tax Planning Letter, which refers to the Act by its commonly used name, “Tax Cuts and Jobs Act”(or simply, the “Act”) describes key changes made under that Act that would affect sole proprietorships, S corporations, partnerships, tax-exempt organizations, electing small business trusts, and retirement plans, including a new deduction for pass-through income. For comprehensive summaries on other areas of the new law, see: (#243) Highlights of the “Tax Cuts and Jobs Act”- Business Tax Changes (#244) Highlights of the “Tax Cuts and Jobs...

As posted by Thomson Reuters on 12/22/17 On 12/22/17, President Trump signed into law H.R. 1, the “Tax Cuts and Jobs Act,” a sweeping tax reform law that will entirely change the tax landscape. The legislation reflects the largest major tax reform in over three decades. This post, which refers to the Act by its commonly used name, “Tax Cuts and Job Act” (or simply, the “Act”) describes key individual tax changes that are made under the Act. This comprehensive tax overhaul dramatically changes the rules governing the taxation of individual taxpayers for tax years beginning before 2026, providing new income tax rates and brackets, increasing the standard deduction, suspending personal deductions, increasing the child tax credit, limiting the state and local tax deduction, and temporarily reducing the medical expense...

As posted by Thomson Reuters on 12/22/17 On 12/22/17, President Trump signed into law H.R. 1, the “Tax Cuts and Jobs Act,” a sweeping tax reform law that will entirely change the tax landscape. The legislation reflects the largest major tax reform in over three decades. This post, which refers to the Act by its commonly used name, “Tax Cuts and Job Act” (or simply, the “Act”) describes key business tax changes that are made under the Act. Among the changes are a permanent reduction in the corporate tax rate to 21%, repeal of the corporate alternative minimum tax (AMT), imposition of new limits on business interest deductions, and a number of changes involving expensing and depreciation. For comprehensive summaries on other areas of the new law, see: (#244)...

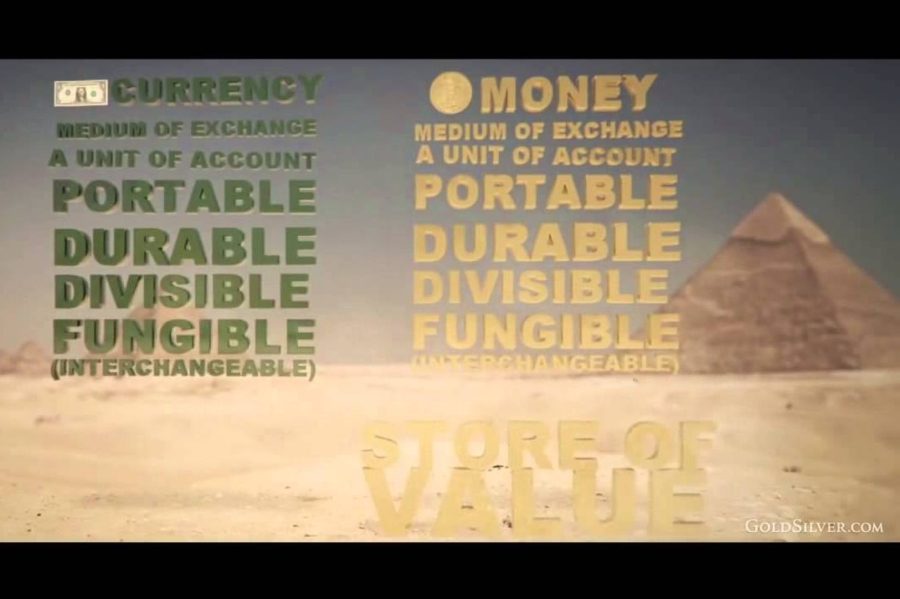

Terms Seemingly Used Interchangeably, What is the Difference? As posted to the GoldSilver YouTube Channel on 2/26/2013 https://youtu.be/DyV0OfU3-FU In this, the first installment of the popular "Hidden Secrets of Money" docu-series, Mike Maloney travels to Egypt to unravel the difference between money and currency. Many people have been led to believe they are the same thing, a misconception that could have dire consequences in the near future. Arguably one of the most important lessons you will ever learn, grasping this concept will pave the way for your understanding of future episodes. Michael Maloney, founder of www.GoldSilver.com is also the author of the world’s best selling book on precious metals investing. Since 2003 he has been advocating gold and silver as the ultimate means of protecting wealth from the games played by our governments...

Debt Ceiling Holiday Ends 3/15/17 As posted to Greg Hunter's USA Watchdog YouTube Channel on February 25, 2017 Former White House Budget Director David Stockman drops a bomb in his latest interview by saying, “I think what people are missing is this date, March 15th 2017. That’s the day that this debt ceiling holiday that Obama and Boehner put together right before the last election in October of 2015. That holiday expires. The debt ceiling will freeze in at $20 trillion. It will then be law. It will be a hard stop. The Treasury will have roughly $200 billion in cash. We are burning cash at a $75 billion a month rate. By summer, they will be out of cash. Then we will be in the mother...

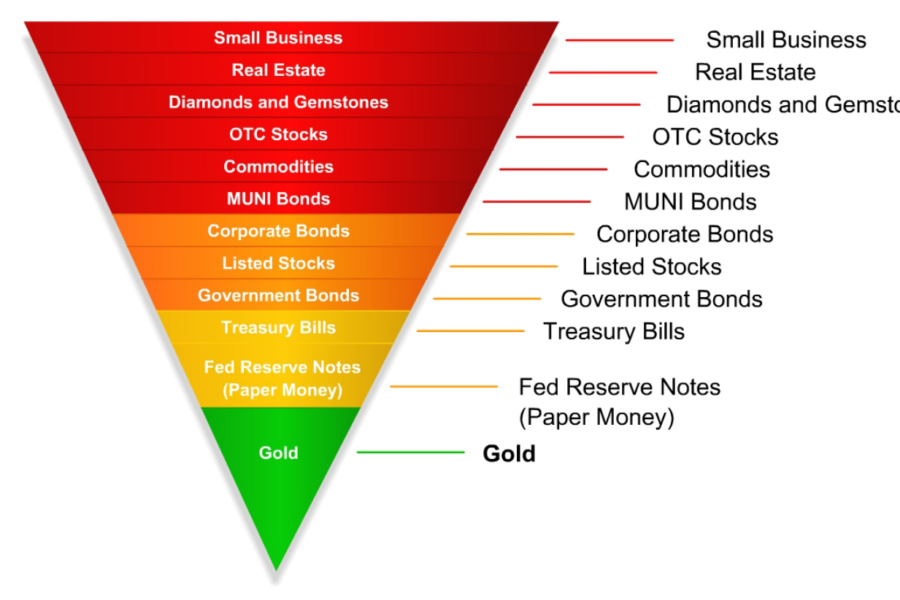

In What Order will Asset Values Fail in the Next Financial Crisis? As posted to LesJones.com on September 9, 2009 Reproduced from the article: "Word of the Day: Exter's Inverted Pyramid of Assets" John Exter’s inverted pyramid. The idea is that things high on the pyramid are derivatives of asset classes further down the pyramid. From FOFOA. Note that in FOFOA’s expanded version of Exter’s inverted pyramid there are all sorts of derivatives at the top of the inverse pyramid. Those derivatives were wildly inflated and at one pointed passed the one quadrillion mark, which is greater than the value of all physical, privately-owned assets on Earth. How is that possible? It’s possible because derivatives and paper markets are often larger than the underlying physical markets. In a nutshell, the...

Introducing CamScanner As posted to the CamCard/CamScanner YouTube Channel on October 28, 2016 https://youtu.be/Z_nlGEkW6ic Back in the day, clients provided their personal tax data in a shoe box . . . everything but the kitchen sink in the form of crumpled up receipts, handwritten notes on scrap paper or napkins, and other "support". Now, in the digital age, data received by our office is almost exclusively electronic. Sometimes however, documents don't show up in the most pristine condition . . . such as when the sender doesn't have a scanner and resorts to taking a distorted photograph of a document with their smart phone. Fortunately, that practice is now poised to be a thing of the past as well. Introducing CamScanner. With CamScanner, any documents you see in real...

Lesson: Leave all Creative Energies Uninhibited As released by the Competitive Enterprise Institute (CEI) in November 2012 https://youtu.be/IYO3tOqDISE In November 2012, the Competitive Enterprise Institute (CEI) released I, Pencil: The Movie, an animated short film adapted from the 1958 essay by Leonard E. Read. Do you know how to make a pencil? You don’t, do you? As Read explained in his classic essay, no single person on earth does. The pencil, like most modern wonders, is the end product of an intricate chain of human activity that spans the globe. There is no mastermind dictating the making of a pencil; not even the CEO of a pencil company could tell you exactly how to make one. It takes little bits of know-how of thousands of individuals—loggers in California, factory...

Valid Reasons for FTB Penalty Abatement As appearing at Spidell's California Minute on 10/9/16 You've been assessed a penalty for the late filing of your return or payment of tax . . . what are your options? One is to claim that you had "reasonable cause" for the infraction. Although it is an option, it is an extremely difficult case to make. In fact, the only reasons that likely work are: taxpayer is seriously ill, taxpayer has died, or taxpayer is the victim of some egregious act over which they had no control, and neither the taxpayer nor their spouse were able to file returns and pay tax. In the attached audio clip (click on photo above to listen), Spidell Publishing's "California Minute" discusses the difficulties of proving reasonable...

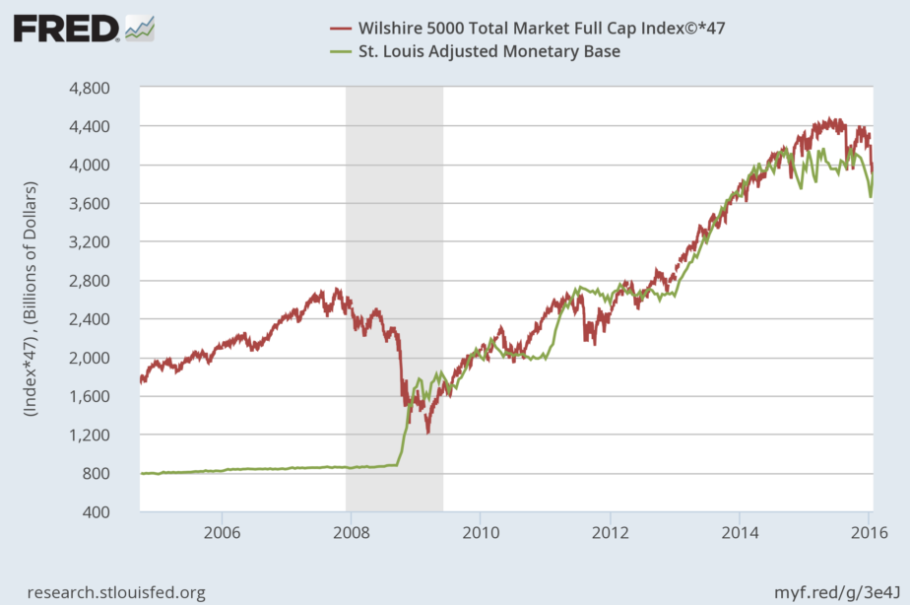

The Stock Market is Exactly Mirroring Base Money As posted to the GoldSilver You Tube Channel on 7/21/16 https://youtu.be/U1RlJuJ9hAw What's behind the recent market rally? In this video, Mike shows you how the market is being pumped up to record highs, (Hint: it's not individual investors doing the buying) and the telltale sign a disaster is in the making. “The stock market will be in for a much bigger plunge than we’ve seen the past couple of times…” -- Mike Maloney Michael Maloney, founder of www.GoldSilver.com is also the author of the world's best selling book on precious metals investing. Since 2003 he has been advocating gold and silver as the ultimate means of protecting wealth from the games played by our governments and banking sector....

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136