If your estate plan includes a revocable trust — also known as a “living” trust — it’s critical to ensure that the trust is properly funded. Revocable trusts offer significant benefits, including asset management (in the event you become incapacitated) and probate avoidance. But these benefits aren’t available if you don’t fund the trust. Funding the trust Funding a living trust is a simple matter of transferring ownership of assets to the trust or, in some cases, designating the trust as beneficiary. Assets you should consider transferring include real estate, bank accounts, certificates of deposit, stocks and other investments, partnership and business interests, vehicles, and personal property (such as furniture and collectibles). Be aware that moving an IRA or qualified retirement plan to a revocable trust can trigger...

As posted to the Be Inspired YouTube Channel on 3/5/19 from original content appearing on the London Real YouTube Channel In this eye-opening interview clip, Robert Kiyosaki explains how you will never learn about money in school. Rather, school was designed to teach you to be an employee or a self-employed person . . . both of which are trading-time-for-dollars endeavors. "The moment I pay you, you think like an employee". With perspectives on money and investing that often contradict conventional wisdom, Robert has earned an international reputation for straight talk, irreverence, and courage and has become a passionate and outspoken advocate for financial education. Robert Kiyosaki is best known as the author of Rich Dad Poor Dad—the #1 personal finance book of all time—Robert Kiyosaki has challenged...

If you participate in a qualified retirement plan, such as a 401(k), you must generally begin taking required minimum withdrawals (RMDs) from the plan no later than April 1 of the year after which you turn age 70½. However, there’s an exception that applies to certain plan participants who are still working for the entire year in which they turn 70½. The basics of RMDs RMDs are the amounts you’re legally required to withdraw from your qualified retirement plans and traditional IRAs after reaching age 70½. Essentially, the tax law requires you to tap into your retirement assets — and begin paying taxes on them — whether you want to or not. Under the tax code, RMDs must begin to be taken from qualified pension, profit sharing and...

Because they foster a collegial, trusting environment, law firms can be more vulnerable to fraud than many other types of businesses. Enforcing internal controls may simply seem unnecessary in an office of professionals dedicated to the law. Unfortunately, occupational thieves can take advantage of such complacency. A law firm’s accounting department — payroll and accounts payable and receivable — may be particularly vulnerable. To protect against financial losses and possible public embarrassment, implement and enforce five basic controls: 1. Screen employees. Require all prospective employees, regardless of level, to complete an employment application with written authorization permitting your firm to verify information provided. Then, call references and conduct background checks (or hire a service to do it). These checks search criminal and court records, pull applicants’ credit...

For years, life insurance has played a critical role in estate planning, providing a source of liquidity to pay estate taxes and other expenses. Today, the gift and estate tax exemption has climbed to $11.4 million, so estate taxes are no longer a concern for the vast majority of families. But even for nontaxable estates, life insurance continues to offer estate planning benefits. Replacing income and wealth Life insurance can protect your family by replacing your lost income. It can also be used to replace wealth in a variety of contexts. For example, suppose you own highly appreciated real estate or other assets and wish to dispose of them without generating current capital gains tax liability. One option is to contribute the assets to a charitable remainder trust...

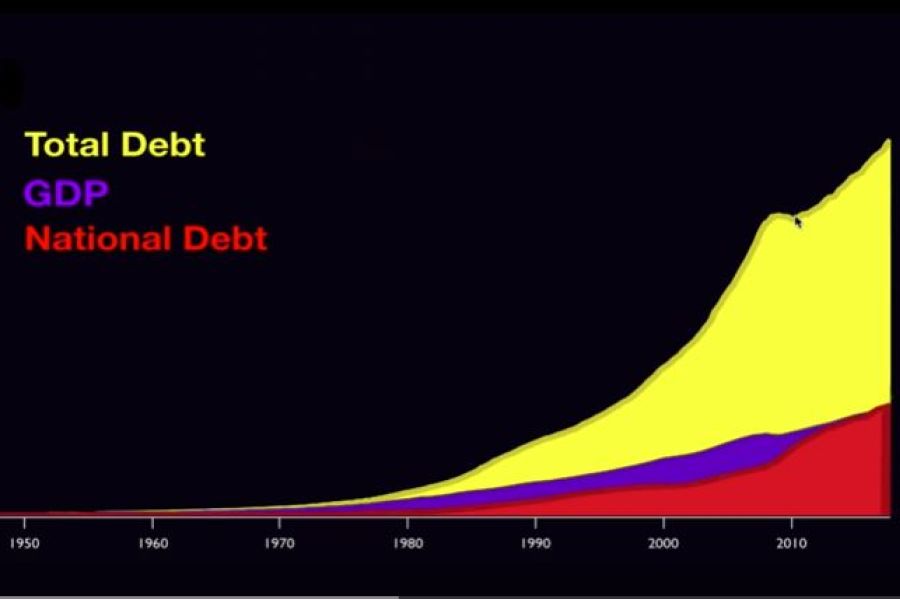

As posted to the GoldSilver YouTube Channel on 03/12/19 (transcript of documentary as appears on YouTube) Today (3/12/19) brings news of the latest federal budget proposal, a $4.75T presidential wishlist doomed to defeat in the House that spends money we don’t have. Perhaps most striking is that we are on pace to shatter the all-time debt-to-GDP record established in 1946 — when the country was in the midst of the life-or-death crisis of World War II — for no other reason than politicians lying to us about what the country can afford. One unrealistic promise after another campaign exaggeration from Democrat and Republican alike, one after the next, has gotten us here. Interest rates are still near historic lows. As the US economy begins to slow, the Fed knows that...

If you’re the parent of a child who is age 17 to 23, and you pay all (or most) of his or her expenses, you may be surprised to learn you’re not eligible for the child tax credit. But there’s a dependent tax credit that may be available to you. It’s not as valuable as the child tax credit, but when you’re saving for college or paying tuition, every dollar counts! Background of the credits The Tax Cuts and Jobs Act (TCJA) increased the child credit to $2,000 per qualifying child under the age of 17. The law also substantially increased the phaseout income thresholds for the credit so more people qualify for it. Unfortunately, the TCJA eliminated dependency exemptions for older children for 2018 through 2025....

Buying a home is stressful enough without also having to worry about potential fraud. Unfortunately, real estate fraud is surging. According to Realtor magazine, scams targeting the industry rose 1,100% from 2015 to 2017, resulting in losses of more than $1.6 billion. Home closing wire fraud should be of particular concern for prospective homebuyers. When schemes are successful, criminals can make off with buyers’ hard-earned down payments — several hundred thousand dollars’ worth in some cases. Here’s how to avoid losing the home of your dreams and the money with which to buy it. The scoop Home closing wire fraud involves hackers who typically use real estate agents’ email accounts to trick homebuyers into wiring money. Perpetrators send phishing messages containing links that, if clicked on, install malware....

In this installment of Millennial Money, Robert Kiyosaki explains that, because the government has mismanaged our economy, millennials will have to be 10 times smarter than him to achieve the same result today that he achieved decades earlier. Being an Business Owner or Investor rather than being an Employee or Self-Employed is now more important than ever. With perspectives on money and investing that often contradict conventional wisdom, Robert has earned an international reputation for straight talk, irreverence, and courage and has become a passionate and outspoken advocate for financial education. The "Millennial Money" series of videos seeks to provide young people with some important economic concepts that they didn't learn in school. Previous episodes of "Millennial Money" Blog #446 - How Debt Can Generate Income Blog #451 -...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136