If your business doesn’t already have a retirement plan, it might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed and set up a SEP-IRA, you can contribute up to 20% of your self-employment earnings, with a maximum contribution of $69,000 for 2024 (up from $66,000 for 2023). If you’re employed by your own corporation, up to 25% of your salary can be contributed to your account, with a maximum contribution of $69,000. If you’re in the 32% federal income tax bracket, making a maximum contribution could cut what you owe Uncle Sam for 2024 by a whopping $22,080 (32% × $69,000). Other possibilities There are more small business retirement plan options, including: 401(k) plans,...

You may have filed your tax return by the due date (4/15/2024), or you may have filed an extension until 10/15/2024. In either case, once your 2023 tax return has been successfully filed with the IRS, there may still be some issues to bear in mind. Here are three considerations. 1. Waiting for your refund? You can check on it The IRS has an online tool that can tell you the status of your refund. Go to irs.gov and click on “Get your refund status” to find out about yours. You’ll need your Social Security number or Individual Taxpayer Identification Number, filing status, and the exact refund amount. 2. Throwing away tax records You should hold on to tax records related to your return for as long as the...

If your company suffers significant losses due to a fraud incident, you may decide to pursue the perpetrator in court, possibly to obtain compensatory damages. Assuming you win your case, you should know that estimating fraud damages is challenging. It generally requires the assistance of a financial expert, who will consider the facts of the case and the harm suffered by your business. Let’s take a look at calculation methods. Benefit-of-the-bargain vs. out-of-pocket Damages experts typically use either the benefit-of-the-bargain or out-of-pocket approach to make estimates. The appropriate method depends to some degree on the location and nature of the fraud. But in most cases, the benefit-of-the-bargain method results in greater restitution for victims. Take, for example, a real estate developer who buys a parcel of land that...

If you operate a business, or you’re starting a new one, you know records of income and expenses need to be kept. Specifically, you should carefully record expenses to claim all the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts reported on your tax returns in case you’re ever audited by the IRS. Be aware that there’s no one way to keep business records. On its website, the IRS states: “You can choose any recordkeeping system suited to your business that clearly shows your income and expenses.” But there are strict rules when it comes to deducting legitimate expenses for tax purposes. And certain types of expenses, such as automobile, travel, meal and home office costs, require...

Merger and acquisition (M&A) activity increased significantly in the fourth quarter of 2023, signaling a hot M&A market for 2024. But there are some potential pitfalls for unwary buyers and sellers. Here are some common mistakes and how a business valuator can help ensure your deal goes as planned. Reliance on valuation rules-of-thumb Some M&A participants rely on industry “rules of thumb” and gut instinct, especially in mature industries. Although rules of thumb can provide a reasonable basis for initial M&A discussions, they fail to address important valuation considerations, such as nonoperating assets and changes in market conditions. Therefore, they’re rarely sufficient as the sole basis for a deal. Before making a formal offer to merge with or acquire another business, it’s important to obtain a comprehensive valuation...

The IRS' recent declaration of a rigorous enforcement against the utilization of corporate jets has attracted widespread attention, as the Biden administration persists in intensifying its examination of affluent individuals and major corporations with intricate tax arrangements. Zeinat Zughayer, a tax controversy manager at Baker Tilly, provided information on the driving force behind the recent wave of audits and the extent of their coverage. The IRS recently declared its intention to commence several audits targeting the apportionment of corporate aircraft usage between business and personal purposes by executives, partners, shareholders, and other individuals for tax-related matters. According to the IRS, the level of personal usage has an effect on the eligibility for specific company deductions. "Utilizing the company jet for personal travel usually leads to the...

As reported in IR-2024-46 Using Inflation Reduction Act funding and as part of ongoing efforts to improve tax compliance in high-income categories, the Internal Revenue Service announced on 2/21/24 plans to begin dozens of audits on business aircraft involving personal use. The audits will be focused on aircraft usage by large corporations, large partnerships and high-income taxpayers and whether for tax purposes the use of jets is being properly allocated between business and personal reasons. The IRS will be using advanced analytics and resources from the Inflation Reduction Act to more closely examine this area, which has not been closely scrutinized during the past decade as agency resources fell sharply. The number of audits related to aircraft usage could increase in the future following initial results and as...

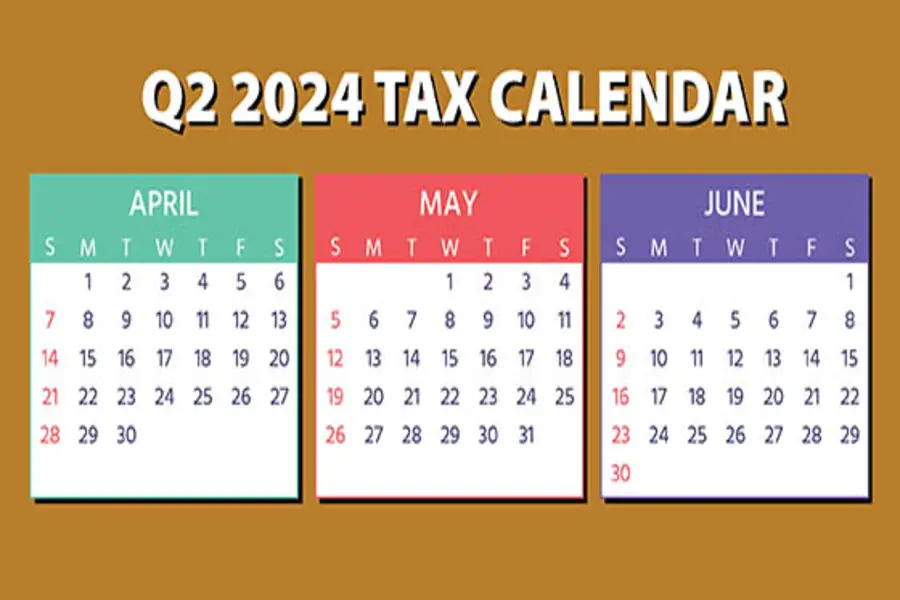

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. April 15 If you’re a calendar-year corporation, file a 2023 income tax return (Form 1120) or file for an automatic six-month extension (Form 7004) and pay any tax due. For corporations, pay the first installment of 2024 estimated income taxes. Complete and retain Form 1120-W (worksheet) for your records. For individuals, file a 2023 income tax return (Form 1040 or Form 1040-SR) or file for an automatic six-month extension (Form...

If you have a tax-favored retirement account, including a traditional IRA, you’ll become exposed to the federal income tax required minimum distribution (RMD) rules after reaching a certain age. If you inherit a tax-favored retirement account, including a traditional or Roth IRA, you’ll also have to deal with these rules. Specifically, you’ll have to: 1) take annual withdrawals from the accounts and pay the resulting income tax and/or 2) reduce the balance in your inherited Roth IRA sooner than you might like. Let’s take a look at the current rules after some recent tax-law changes. RMD basics The RMD rules require affected individuals to take annual withdrawals from tax-favored accounts. Except for RMDs that meet the definition of tax-free Roth IRA distributions, RMDs will generally trigger a federal income...

Many businesses support their communities by donating to local charities. Although there are plenty of non-profits that deserve your support, some exist solely to facilitate fraud. How can you avoid the latter? Familiarize yourself with the deceptive tactics scammers use and carefully screen charities for legitimacy — before you write a check. Branding tricks Fraud perpetrators employ many tried-and-tested approaches to trick businesses into donating to fake charities. One of the most effective ways that they secure donations is by creating entities that resemble established non-profits. They use familiar-sounding names and familiar-looking logos. They also make their websites and marketing materials appear like those of the charities they’re impersonating. These scammers often use their fake branding in emails and on social media platforms. Not only do they hope...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136