You may pay out a bundle in out-of-pocket medical costs each year. But can you deduct them on your tax return? It’s possible but not easy. Medical expenses can be claimed as a deduction only to the extent your unreimbursed costs exceed 7.5% of your adjusted gross income. Plus, medical expenses are deductible only if you itemize, which means that your itemized deductions must exceed your standard deduction. Qualifying costs include many items other than hospital and doctor bills. Here are some items to take into account in determining a possible deduction: Insurance premiums. The cost of health insurance is a medical expense that can total thousands of dollars a year. Even if your employer provides you with coverage, you can deduct the portion of the premiums you...

Do you want to sell commercial or investment real estate that has appreciated significantly? One way to defer a tax bill on the gain is with a §1031 “like-kind” exchange where you exchange the property rather than sell it. With real estate prices up in some markets (and higher resulting tax bills), the like-kind exchange strategy may be attractive. A like-kind exchange is any exchange of real property held for investment or for productive use in your trade or business (relinquished property) for like-kind investment, trade or business real property (replacement property). For these purposes, like-kind is broadly defined, and most real property is considered to be like-kind with other real property. However, neither the relinquished property nor the replacement property can be real property held primarily...

Many employees — from retail workers to sales staffers involved in complex business-to-business transactions — receive part of their compensation from sales-related commissions. To attract and retain top talent, some companies even allow employees to earn unlimited commissions. Unfortunately, some commission-compensated employees may be tempted to abuse this system by falsifying sales or rates. Fraud methods vary depending on an unethical salesperson’s employer and role. But companies need to be aware of the possibility of commission fraud and take steps to prevent it. 3 forms Generally, commission fraud takes one of three forms: Invention of sales. A retail employee enters a fake purchase at the point of sale (POS) to generate a commission. Or an employee involved in selling business services creates a fraudulent sales contract. Overstatement of sales....

The number of people engaged in the “gig” or sharing economy has grown in recent years. In an August 2021 survey, the Pew Research Center found that 16% of Americans have earned money at some time through online gig platforms. This includes providing car rides, shopping for groceries, walking dogs, performing household tasks, running errands and making deliveries from a restaurant or store. There are tax consequences for the people who perform these jobs. Basically, if you receive income from an online platform offering goods and services, it’s generally taxable. That’s true even if the income comes from a side job and even if you don’t receive an income statement reporting the amount of money you made. Traits of gig workers Gig workers are those who are independent...

Valuation experts often use discounted cash flow (DCF) techniques to determine the value of a business or estimate economic losses. A critical input in a DCF model is the cost of capital. This is the rate that’s used to discount future earnings into today’s dollars. Small changes in this rate can have a major impact on the expert’s conclusion, so it’s important to get it right. Debt vs. equity The term “cost of capital” refers to the expected rate of return that the market requires to attract funds to a particular investment. The cost of capital is based on the perceived risk of the investment. Risky companies (or investments) warrant a higher discount rate and, therefore, a lower value (and vice versa). A business can be financed with...

After two years of no increases, the optional standard mileage rate used to calculate the deductible cost of operating an automobile for business will be going up in 2022 by 2.5 cents per mile. The IRS recently announced that the cents-per-mile rate for the business use of a car, van, pickup or panel truck will be 58.5 cents (up from 56 cents for 2021). The increased tax deduction partly reflects the price of gasoline. On December 21, 2021, the national average price of a gallon of regular gas was $3.29, compared with $2.22 a year earlier, according to AAA Gas Prices. Don’t want to keep track of actual expenses? Businesses can generally deduct the actual expenses attributable to business use of vehicles. This includes gas, oil, tires, insurance, repairs,...

If you’re paying back college loans for yourself or your children, you may wonder if you can deduct the interest you pay on the loans. The answer is yes, subject to certain limits. The maximum amount of student loan interest you can deduct each year is $2,500. Unfortunately, the deduction is phased out if your adjusted gross income (AGI) exceeds certain levels, and as explained below, the levels aren’t very high. The interest must be for a “qualified education loan,” which means a debt incurred to pay tuition, room and board, and related expenses to attend a post-high school educational institution, including certain vocational schools. Certain postgraduate programs also qualify. Therefore, an internship or residency program leading to a degree or certificate awarded by an institution...

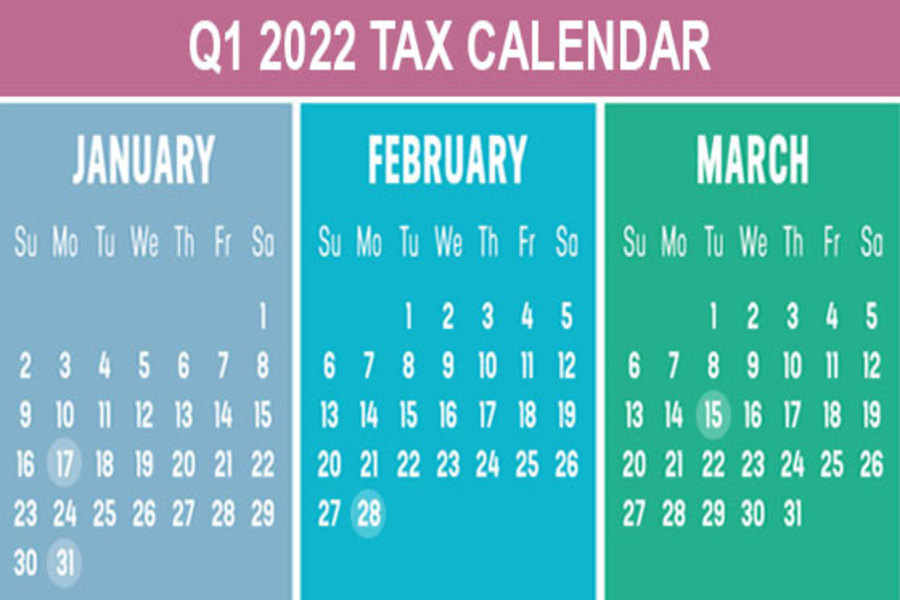

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January 17 (The usual deadline of January 15 is a Saturday) Pay the final installment of 2021 estimated tax. Farmers and fishermen: Pay estimated tax for 2021. January 31 File 2021 Forms W-2, “Wage and Tax Statement,” with the Social Security Administration and provide copies to your employees. Provide copies of 2021 Forms 1099-MISC, “Miscellaneous Income,” to recipients of income from your business where required. File 2021 Forms 1099-MISC, reporting nonemployee compensation payments...

Companies of all sizes routinely outsource work to third-party contractors. Yet, each third-party hire comes with risk. Whether deliberate or unintentional, a third party’s actions can cost you money and harm your company’s reputation — particularly if they violate laws and regulations. Here’s how to contain possible threats. Potential problems Suppose your company employs an overseas trucking company to transport goods from a port to a customer’s warehouse. The driver could pay a kickback to customs personnel to release shipments quickly — potentially subjecting your business to bribery and corruption charges locally and in the United States. In another scenario, a third party might expose your company to excessive risk because it lacks a robust cybersecurity program and is easily hacked. This is what happened when Target Corporation...

As posted to the Munro Live YouTube Channel on 11/24/2021 (Run Time 46 min, 32 sec) Regarding the accelerating move to EVs, legendary automotive engineer Sandy Munro believes that OEMs are experiencing Scotoma, aka Paradigm Paralysis. They cannot physiologically see the data that is unfolding around them. When a paradigm shifts, success in the old paradigm will block your vision of the future. When a paradigm changes, everything goes back to zero. Your past success means nothing. GM promised 20 new EVs by 2023, yet they brought zero to the recent 2021 LA Auto Show. The EV technology disruption happening in the automotive industry is of an order of magnitude such that many OEMs simply will not survive. Who's going to win when one company (or country) is thinking...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136