Do you buy or lease computer software to use in your business? Do you develop computer software for use in your business, or for sale or lease to others? Then you should be aware of the complex rules that apply to determine the tax rules for deducting software, whether you're buying, leasing or developing. Purchased software Some software costs are deemed to be costs of “purchased” software, meaning software that’s either: Non-customized software available to the general public under a non-exclusive license or Acquired from a contractor who is at economic risk should the software not perform. The entire cost of purchased software can be deducted in the year that it’s placed into service. The cases in which the costs are ineligible for this immediate write-off are the...

Management consulting company McKinsey reports that synthetic identity theft is growing fast. In fact, it's the fastest growing financial crime in the United States. And a LexisNexis Risk Solutions study has found that 20% of ID theft losses by banks can be attributed to synthetic versions of the scheme. If you’re unfamiliar with synthetic ID theft, you should know that it’s not — as its name might imply — a weaker, less “real” form of fraud. In fact, it tends to be much harder to prevent and detect. That’s because all a perpetrator needs to create an identity for criminal purposes is a Social Security number (SSN). Frankenstein monsters Traditionally, identity theft occurs when a thief gets hold of someone’s personal information and uses it to assume his...

As posted to the Tony Seba YouTube Channel on 10/30/2019 (Run Time 31 min, 17 sec) Based on Tony Seba's #1 Amazon bestselling book "Clean Disruption of Energy and Transportation" and "Rethinking Transportation 2020-2030", this presentation lays out the key technologies (batteries, electric vehicles, autonomous vehicles), business model innovations (ride-hailing, transportation-as-a-service), how the technology disruption will affect existing companies and sectors (market trauma) and how it will unfold over the next decade, as well as key implications for society, finance, industry, cities, and infrastructure. (This is Blog Post #907) Tony Seba is the author of "Clean Disruption of Energy and Transportation - How Silicon Valley Will Make Oil, Nuclear, Natural Gas, Coal, Electric Utilities and Conventional Cars Obsolete by 2030" and "Rethinking Transportation 2020-2030". He is the creator of...

In some cases, investors have significant related expenses, such as the cost of subscriptions to financial periodicals and clerical expenses. Are they tax deductible? Under the Tax Cut and Jobs Act, these expenses aren’t deductible through 2025 if they’re considered expenses for the production of income. But they are deductible if they’re considered trade or business expenses. (For tax years before 2018, production-of-income expenses were deductible, but were included in miscellaneous itemized deductions, which were subject to a 2%-of-adjusted-gross-income floor.) The deductibility of portfolio management and related invesmtnet expenses requires determining if you’re an investor or a trader — and be aware that it’s more advantageous (and difficult) to qualify for trader status. Engaged in a Trade or Business To qualify, you must be engaged in a...

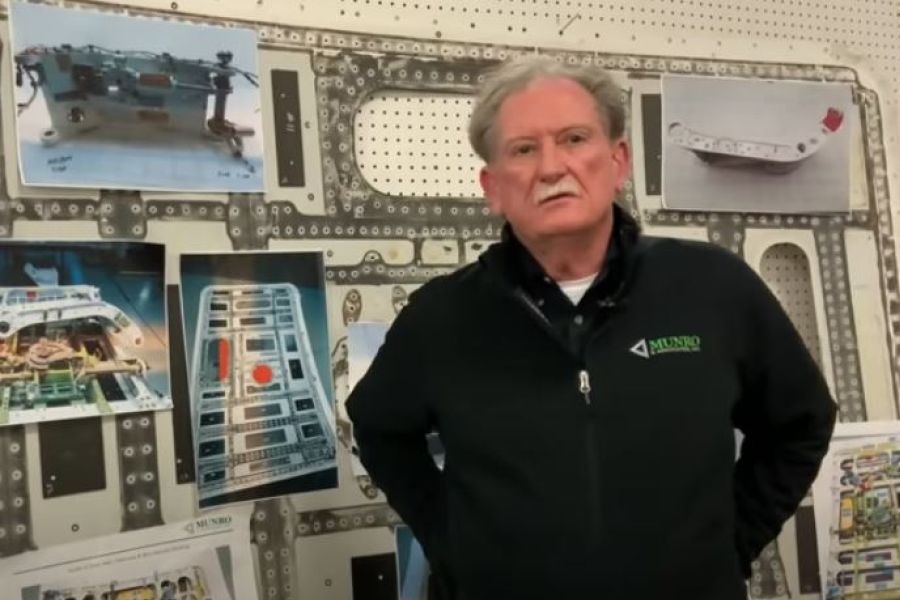

As posted to the Munro Live YouTube Channel on 10/9/2020 (Run Time 22 min, 38 sec) This video is an "abridged" version of a presentation given by legendary automotive engineer Sandy Munro in September, 2020. On Testa's growing lead in technology, Sandy comments, "It is not the big that eat the small, but rather the fast that eat the slow". (This is Blog Post #905) Sandy Munro is an automotive engineer who specializes in machine tools and manufacturing. He joined the Ford Motor Company in 1978 and then started his own consulting company, Munro & Associates, which specializes in lean design, tearing down automotive products to study and suggest improvements and innovations....

Forensic accountants have many tools to help them find evidence of hidden assets or fraud. But one of the most effective, particularly in divorce matters or legal disputes with former business partners, is using lifestyle analysis to find hidden income and assets. This method involves developing a financial profile of a subject and then examining mismatches between the person’s known resources and lifestyle. Financial profiling Forensic accountants develop a financial profile of a subject by examining: Bank deposits. The expert reconstructs the subject’s income by analyzing bank deposits, canceled checks and currency transactions, as well as accounts for cash payments from undeposited receipts and non-income cash sources, such as gifts and insurance proceeds. Expenditures. Here, the expert analyzes the subject’s personal income sources and uses of cash during a...

(This is Blog Post #903)...

The business use of websites is widespread. But surprisingly, the IRS hasn’t yet issued formal guidance on when Internet website costs can be deducted. Fortunately, established rules that generally apply to the deductibility of business costs, and IRS guidance that applies to software costs, provide business taxpayers launching a website with some guidance as to the proper treatment of the costs. Hardware or software? Let’s start with the hardware you may need to operate a website. The costs involved fall under the standard rules for depreciable equipment. Specifically, once these assets are up and running, you can deduct 100% of the cost in the first year they’re placed in service (before 2023). This favorable treatment is allowed under the 100% first-year bonus depreciation break. In later years, you can...

Maybe the numbers didn’t add up during your company’s recent inventory count. You know that most inventory discrepancies are the result of honest mistakes, such as when employees return items to the wrong shelves or customer returns are flubbed. It’s even possible that you’ve made a mistake and need to perform a recount. But if you suspect something more sinister — such as employee theft — don’t hesitate to call in reinforcements. A forensic accountant can assist in getting the goods on inventory theft. Where the clues are When fraud experts can’t find “innocent” explanations for missing inventory, they look at the business’s culture and environment. Poor controls over purchasing, receiving and cash disbursement puts companies at higher risk of employee theft. And if one person performs...

I'm happy to report that my second ad has now been published in 2020 Issue 3 of the California New Car Dealers Association quarterly magazine, "California New Car Dealer Quarterly". (Run time 2 min, 0 sec) Whether you’re a successful General Manager that now finds him or herself a newly minted Dealer Principal seeking an Automobile Dealership CPA Firm . . . or a seasoned automotive veteran looking to make a change to an Automotive CPA that understands your business . . . we need to talk. I’m Roger Rossmeisl, a senior partner with Kho & Patel CPAs with offices in Southern California. For the past 35+ years my practice has been serving franchise new vehicle dealerships with their tax, attest and consulting needs. Today, an automotive-centric CPA is...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136