Most restaurants are finally reopening to in-person dining. And while you may now be thinking about luring customers back, hiring enough workers and managing supply-chain shortages, one issue has remained the same: fraud. Restaurants often face fraud threats from employees, customers and vendors. So now isn’t the time to drop your guard. Potential risks Your restaurant may have high transaction volumes but lack the technology linking point-of-sale, inventory and accounting systems. This leaves gaps for fraudsters to exploit. Employees could, for example, provide food and drinks to friends without entering the sales — or ring up only a portion of friends’ bills. They might issue voids or refunds when there was no original sale and pocket the proceeds. Or they could overcharge customers by, say, charging for...

As we continue to come out of the COVID-19 pandemic, you may be traveling for business again. Under tax law, there are a number of rules for deducting the cost of your out-of-town business travel within the United States. These rules apply if the business conducted out of town reasonably requires an overnight stay. Note that under the Tax Cuts and Jobs Act (TCJA) , employees can’t deduct their unreimbursed travel expenses through 2025 on their own tax returns. That’s because unreimbursed employee business expenses are “miscellaneous itemized deductions” that aren’t deductible through 2025. However, self-employed individuals can continue to deduct business expenses, including away-from-home travel expenses. Here are some of the rules that come into play. Transportation and meals The actual costs of travel (for example, plane fare and...

If you’re a parent with a college-bound child, you may be concerned about being able to fund future tuition and other higher education costs. You want to take maximum advantage of tax benefits to minimize your expenses. Here are some possible options. Savings bonds Series EE U.S. savings bonds offer two tax-saving opportunities for eligible families when used to finance college: You don’t have to report the interest on the bonds for federal tax purposes until the bonds are cashed in, and Interest on “qualified” Series EE (and Series I) bonds may be exempt from federal tax if the bond proceeds are used for qualified education expenses. To qualify for the tax exemption for college use, you must purchase the bonds in your name (not the child’s) or...

To use their ill-gotten cash, criminals must make it appear legitimate. That’s the job performed by money launderers, who increasingly use cryptocurrencies. According to digital currency analytics company Elliptic, crooks use them to launder $3 to $4 billion per year. With over 4,000 digital currencies to choose from, they gain access to a liquid asset that’s cost effective and usually untraceable. But cryptocurrencies may also have something to offer legitimate businesses. Let’s look at the pros and cons. Accepting cryptocurrencies Some banks deny customers the ability to deposit digital currencies. They often cite laws that make it illegal to process cryptocurrencies, concerns about security and a lack of infrastructure to support such transactions. But even though banks are reluctant to embrace cryptocurrency, there are some potential benefits for businesses....

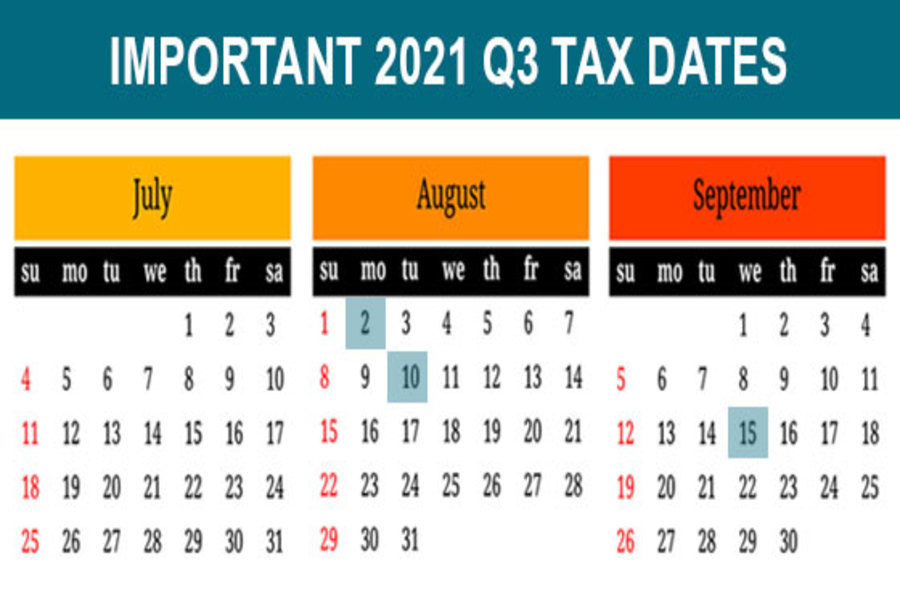

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Monday, August 2 Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941) and pay any tax due. Employers file a 2020 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension. Tuesday, August 10 Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941), if you deposited all associated taxes that were due in full and on time. Wednesday, September 15 Individuals...

If you’re getting ready to retire, you’ll soon experience changes in your lifestyle and income sources that may have numerous tax implications. Here’s a brief rundown of four tax and financial issues you may deal with when you retire: Taking required minimum distributions This is the minimum amount you must withdraw from your retirement accounts. You generally must start taking withdrawals from your IRA, SEP, SIMPLE and other retirement plan accounts when you reach age 72 (70½ before January 1, 2020). Roth IRAs don’t require withdrawals until after the death of the owner. You can withdraw more than the minimum required amount. Your withdrawals will be included in your taxable income except for any part that was taxed before or that can be received tax-free (such as qualified distributions...

If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or try to create records months (or years) later. In doing so, they fail to meet the strict substantiation requirements set forth under tax law. Tax auditors are adept at rooting out inconsistencies, omissions and errors in taxpayers’ records, as illustrated by one recent U.S. Tax Court case. Facts of the case In the case, the taxpayer ran a notary and paralegal business. She deducted business meals and vehicle expenses that she allegedly incurred in connection with her business. The deductions were denied by the IRS and the court. Tax law “establishes higher substantiation requirements” for these and certain other expenses, the court noted....

Compiled annually, the “Dirty Dozen” lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. This year's "Dirty Dozen" is separated into four separate categories: Pandemic-related scams like Economic Impact Payment theft (See Blog Post 1049) Personal information cons including phishing, ransomware and phone "vishing" (See Blog Post 1050) Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud (See Blog Post 1051) Schemes that persuade taxpayers into unscrupulous actions such as Offer In Compromise mills and syndicated conservation easements (This Blog Post) The Internal Revenue Service, in IR 2021-144, concluded the "Dirty Dozen" list of tax scams with a warning to taxpayers...

Compiled annually, the “Dirty Dozen” lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. This year's "Dirty Dozen" is separated into four separate categories: Pandemic-related scams like Economic Impact Payment theft (See Blog Post 1049) Personal information cons including phishing, ransomware and phone "vishing" (See Blog Post 1050) Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud (This Blog Post) Schemes that persuade taxpayers into unscrupulous actions such as Offer In Compromise mills and syndicated conservation easements (See Blog Post 1052) The Internal Revenue Service, via IR 2021-141, continued its "Dirty Dozen" tax scams with a warning for people to watch...

Compiled annually, the “Dirty Dozen” lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. This year's "Dirty Dozen" is separated into four separate categories: Pandemic-related scams like Economic Impact Payment theft (See Blog Post 1049) Personal information cons including phishing, ransomware and phone "vishing" (This Blog Post) Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud (See Blog Post 1051) Schemes that persuade taxpayers into unscrupulous actions such as Offer In Compromise mills and syndicated conservation easements (See Blog Post 1052) The Internal Revenue Service, via IR 2021-137, continues its "Dirty Dozen" scam series with a warning to taxpayers to watch...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136