Although merger and acquisition activity has been down in 2022, there are still companies being bought and sold. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law. Stocks vs. assets From a tax standpoint, a transaction can basically be structured in two ways: 1. Stock (or ownership interest). A buyer can directly purchase a seller’s ownership interest if the target business is operated as a C or S corporation, a partnership, or a limited liability company (LLC) that’s treated as a partnership for tax purposes. The current 21% corporate federal income tax rate makes buying the stock of a C corporation somewhat more attractive. Reasons: The corporation will pay less tax and generate more...

It’s not just businesses that can deduct vehicle-related expenses on their tax returns. Individuals also can deduct them in certain circumstances. Unfortunately, under current law, you may not be able to deduct as much as you could years ago. For years prior to 2018, miles driven for business, moving, medical and charitable purposes were potentially deductible. For 2018 through 2025, business and moving miles are deductible only in much more limited circumstances. The changes were a result of the Tax Cuts and Jobs Act (TCJA), which could also affect your tax benefit from medical and charitable miles. Fortunately, if you’re eligible to deduct driving costs, the IRS just increased the standard amounts for the second half of 2022 due to the high price of gas. Current vs. past...

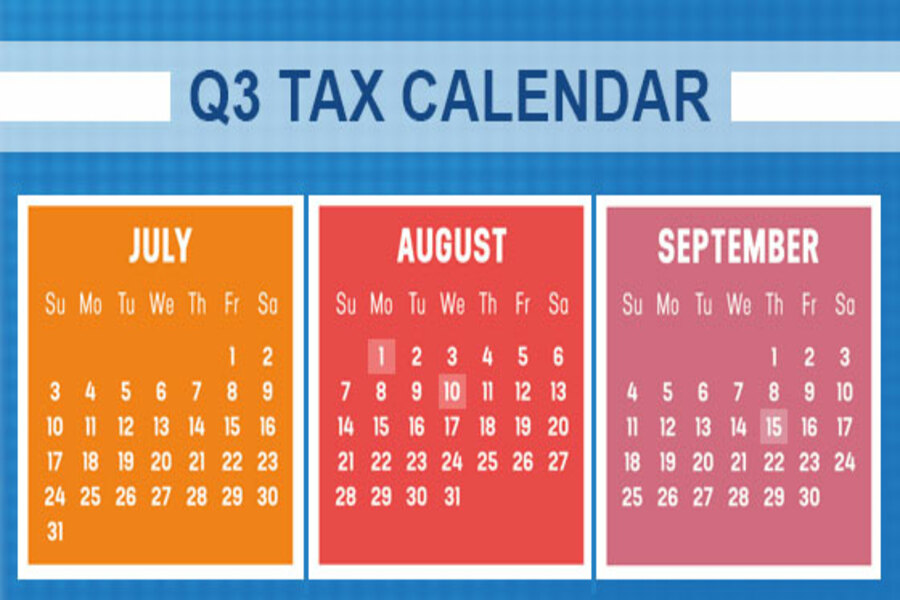

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. August 1 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), and pay any tax due. (See the exception below, under “August 10.”) File a 2021 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension. August 10 Report income tax withholding and FICA taxes for second quarter 2022 (Form 941), if you deposited on time and in full all of the associated taxes due. September 15 ...

When valuing a business using the discounted cash flow method, residual (or terminal) value is a key component. The International Valuation Glossary — Business Valuation defines residual value as “the value as of the end of the discrete projection period in a discounted future earnings model.” Business valuation experts typically consider the capitalization of earnings method and the market approach when estimating residual value. Either (or both) may be appropriate, depending on the nature of the business, purpose of the valuation, reliability of the company’s financial projections and availability of market data. Capitalizing earnings The capitalization of earnings method is based on the assumption that cash flow will stabilize in the final year of the projection period. However, this is also the time period that’s subject to the...

Are you in the early stages of divorce? In addition to the tough personal issues that you’re dealing with, several tax concerns need to be addressed to ensure that taxes are kept to a minimum and that important tax-related decisions are properly made. Here are five issues to consider if you’re in the process of getting a divorce. Alimony or support payments. For alimony under divorce or separation agreements that are executed after 2018, there’s no deduction for alimony and separation support payments for the spouse making them. And the alimony payments aren’t included in the gross income of the spouse receiving them. (The rules are different for divorce or separation agreements executed before 2019.) Child support. No matter when the divorce or separation instrument is executed,...

If most of your employees have worked from home since the start of the pandemic or are only gradually transitioning back to onsite work, your office may be emptier than in pre-COVID days. This can make theft easier. “Creepers” can gain access to offices or other physical facilities via unlocked doors and social engineering techniques and steal whatever they can get their hands on. They may even engage in corporate espionage and network hacking. Common schemes In a common creeper scheme, individuals pose as employees. They might enter a normally locked office by chatting with employees outside the building, then follow them through the door. If questioned, they could claim they left their badges at home. When the coast is clear, they steal purses, mobile devices and...

Business owners are aware that the price of gas is historically high, which has made their vehicle costs soar. The average nationwide price of a gallon of unleaded regular gas on June 17 was $5, compared with $3.08 a year earlier, according to the AAA Gas Prices website. A gallon of diesel averaged $5.78 a gallon, compared with $3.21 a year earlier. Fortunately, the IRS is providing some relief. The tax agency announced an increase in the optional standard mileage rate for the last six months of 2022. Taxpayers may use the optional cents-per-mile rate to calculate the deductible costs of operating a vehicle for business. For the second half of 2022 (July 1–December 31), the standard mileage rate for business travel will be 62.5 cents per...

Home Energy Saver Website: hes.lbl.gov/consumer (This is Blog Post #1238)...

As a result of the current estate tax exemption amount ($12.06 million in 2022), many people no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. Now, because many estates won’t be subject to estate tax, more planning can be devoted to saving income taxes for your heirs. Note: The federal estate tax exclusion amount is scheduled to sunset at the end of 2025. Beginning on January 1, 2026, the amount is due to be reduced to $5 million, adjusted for inflation. Of course, Congress could act to extend the higher amount or institute a new amount. Here are some strategies to consider in light of the current large exemption amount. Gifts that use...

There’s a valuable tax deduction available to a C corporation when it receives dividends. The “dividends-received deduction” is designed to reduce or eliminate an extra level of tax on dividends received by a corporation. As a result, a corporation will typically be taxed at a lower rate on dividends than on capital gains. Ordinarily, the deduction is 50% of the dividend, with the result that only 50% of the dividend received is effectively subject to tax. For example, if your corporation receives a $1,000 dividend, it includes $1,000 in income, but after the $500 dividends-received deduction, its taxable income from the dividend is only $500. The deductible percentage of a dividend will increase to 65% of the dividend if your corporation owns 20% or more (by vote...

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136