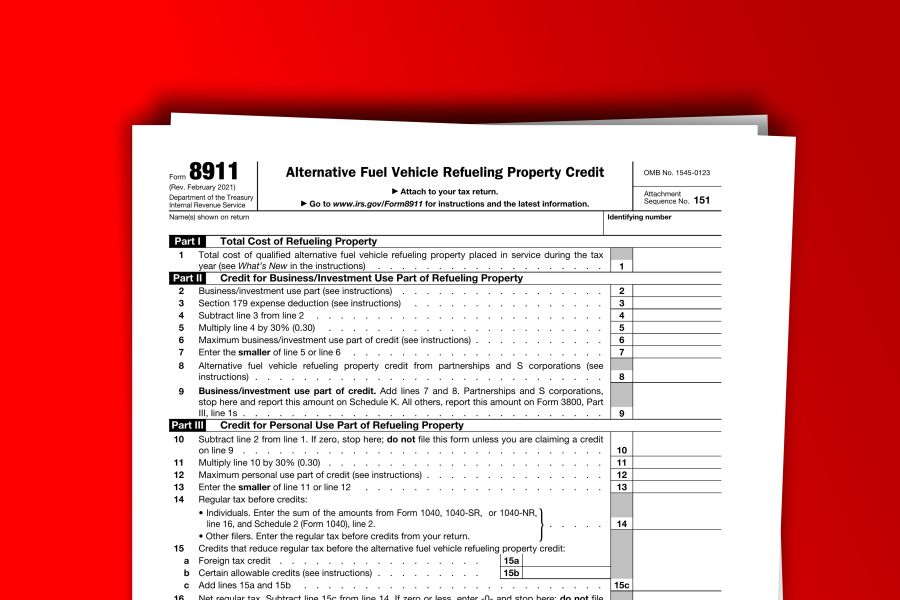

As reported via IR-2024-16 on 1/19/2024 The Internal Revenue Service and the Department of the Treasury today issued Notice 2024-20 to provide guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit (the tax credit applicable to the installation of EV chargers) and to announce the intent to propose regulations for the credit. The Inflation Reduction Act amended the credit for qualified alternative fuel vehicle refueling property. The changes apply to qualified alternative fuel vehicle refueling property placed in service after December 31, 2022 and before January 1, 2033. Business vs Non-Business Property Property Not Subject to Depreciation The credit amount for property not subject to depreciation is 30% of the cost of the qualified property placed in service during the tax year. The credit is...

As the Financial Crimes Enforcement Network (FinCEN) opens its beneficial ownership information (BOI) reporting portal, its BOI webpage, reflects a fraud alert for individuals and entities who may be subject to beneficial ownership information (BOI) reporting. According to the FinCEN fraud alert, individuals and entities that may be subject to the beneficial ownership information (BOI) reporting requirements have been receiving fraudulent correspondence, via email or traditional mail, that appears as though it came from FinCEN. In some instances, the fraudulent correspondence may be titled "Important Compliance Notice" and ask the recipient to click on a URL or to scan a QR code. Be advised that e-mails or letters such as this are fraudulent, according to the alert. FinCEN cautions individuals that it does not send unsolicited requests for information,...

Starting in 2024 newly formed, corporations, limited liability companies (LLCs), limited partnerships, and other entities that file formation papers with a state’s Secretary of State’s office (or similar government agency) must file a report with the U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) providing specified information regarding the entity’s “beneficial owners” (the so-called BOI reporting requirement under the Corporate Transparency Act). Entities in existence prior to January 1, 2024, have until January 1, 2025, to file these reports. Penalties are steep This is part of the federal government’s anti-money laundering and anti-tax evasion efforts and is an attempt to look beyond shell companies that are set up to hide money. Unfortunately, this will impose burdensome reporting requirements on most businesses, and the willful failure to report...

The IRS just put up a new webpage and released FAQs having to do with the recently announced Employee Retention Tax Credit (ERTC) Voluntary Disclosure Program. ERTC Voluntary Disclosure Program On December 21, 2023, the IRS announced a new Voluntary Disclosure Program for businesses who claimed the ERC erroneously. The program is part of the IRS' continuing efforts to combat questionable ERTC claims. This special disclosure program affords taxpayers the ability to repay only 80% of the claim received. The program runs through March 22, 2024. New webpage: The new webpage provides information on the advantages of participating in the program, who can apply, how to apply, as well as next steps. FAQs: The FAQs provide detailed information on eligibility, the program process, calculating and paying the amount...

As reported via IR-2023-247 on 12/21/2023 As part of an ongoing initiative aimed at combating dubious Employee Retention Tax Credit (ERTC) claims, the Internal Revenue Service launched a new Voluntary Disclosure Program to help businesses who want to pay back the money they received after filing ERTC claims in error. The new disclosure program, which has been in the works for several months, is part of a larger effort at the IRS to stop aggressive marketing around ERTC that misled some employers into filing claims. The special disclosure program runs through March 22, 2024, and the IRS added provisions allowing repayment of 80% of the claim received. The IRS also continues to urge employers with pending ERTC claims to consider a separate withdrawal program that allows them to...

As reported via IR-2023-230 on 12/6/2023 As part of continuing efforts to combat dubious Employee Retention Tax Credit (ERTC) claims, the Internal Revenue Service is sending an initial round of more than 20,000 letters to taxpayers notifying them of disallowed ERTC claims. IRS is disallowing claims to entities that: did not exist, or did not have paid employees during the period of eligibility to prevent improper ERTC payments from being made to ineligible entities. The letters are being sent as the IRS continues increased scrutiny of ERTC claims in response to misleading marketing campaigns that have targeted small businesses and other organizations. The IRS mailing is the latest in an expanded compliance effort that includes a special withdrawal program for those with pending claims who realize they...

As reported via IR-2023-193 on 10/19/2023 Special initiative aimed at helping businesses concerned about an ineligible claim amid aggressive marketing, scams As part of a larger effort to protect small businesses and organizations from scams, the Internal Revenue Service announced the details of a special withdrawal process to help those who filed an Employee Retention Tax Credit (ERTC) claim and are concerned about its accuracy. This new withdrawal option allows certain employers that filed an ERTC claim but have not yet received a refund to withdraw their submission and avoid future repayment, interest and penalties. Employers that submitted an ERTC claim that's still being processed can withdraw their claim and avoid the possibility of getting a refund for which they're ineligible. The IRS created the withdrawal option to help...

As reported via IR-2023-202 on 11/1/2023 IRS opens free Energy Credit Online tool for sellers of clean vehicles to register for time-of-sale reporting and dealer advance payments for the Clean Vehicle Credit The Internal Revenue Service announced today that sellers of clean vehicles can now register using the new IRS Energy Credits Online tool, available free from the IRS. Known as IRS Energy Credits Online or IRS ECO, this free electronic service is secure, accurate and requires no special software. Though available to any business of any size, IRS Energy Credit Online may be especially helpful to any small business that currently sells clean vehicles. The IRS’s new Energy Credits Online tool will allow dealers and sellers of clean vehicles to complete the entire process online and receive advance...

As appearing in IRS IR-2023-169 To protect taxpayers from scams, IRS orders immediate stop to new Employee Retention Tax Credit (ERTC) processing amid surge of questionable claims Concerns from tax pros, aggressive marketing to ineligible applicants highlights unacceptable risk to businesses and the tax system Moratorium on processing of new claims through year’s end will allow IRS to add more safeguards to prevent future abuse, protect businesses from predatory tactics; IRS working with Justice Department to pursue fraud fueled by aggressive marketing WASHINGTON – Amid rising concerns about a flood of improper Employee Retention Credit claims, the Internal Revenue Service today announced an immediate moratorium through at least the end of the year on processing new claims for the pandemic-era relief program to protect honest small business owners from...

As appearing in IRS Newswire IR-2023-64 The Internal Revenue Service just issued a proposed regulation related to certain requirements that must be met for critical minerals and battery components for the new clean vehicle credit. The Inflation Reduction Act (IRA) allows a maximum credit of $7,500 per vehicle, consisting of $3,750 in the case of a vehicle that meets certain requirements relating to critical minerals and $3,750 in the case of a vehicle that meets certain requirements relating to battery components. The critical mineral and battery component requirements will apply to vehicles placed in service on or after April 18, 2023, the day after the Notice of Proposed Rulemaking is issued in the Federal Register. New clean vehicles placed in service on or after April 18, 2023, are subject...