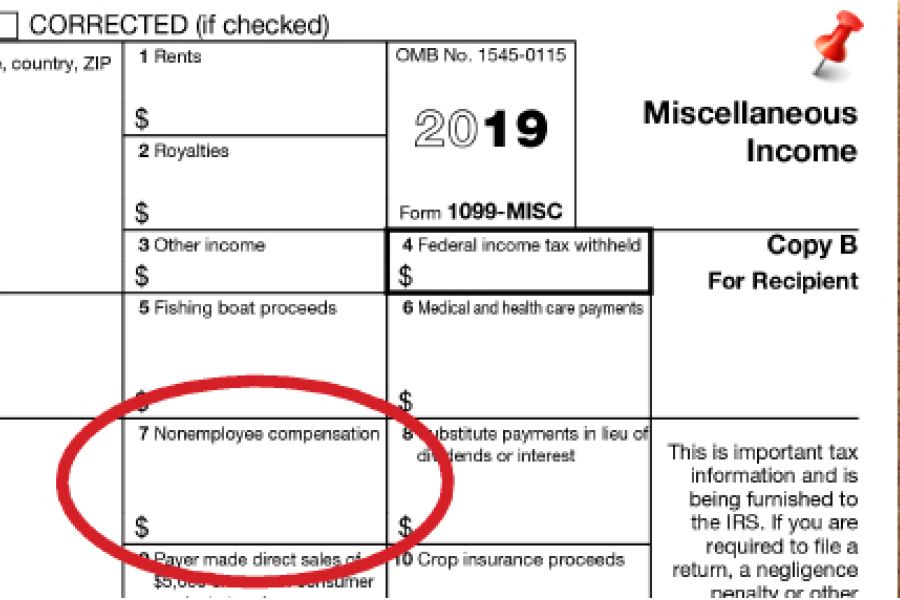

It's 2020, and with it your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. 1099-MISC reporting requirements may mean you have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time consuming and there are penalties for not complying, so it’s a good idea to begin gathering information early to help ensure smooth filing. Deadline There are many types of 1099 forms. For example, 1099-INT is sent out to report interest income and 1099-B is used to report broker transactions and barter exchanges. Employers must provide a Form 1099-MISC for nonemployee compensation by January 31, 2020, to each noncorporate service provider who was...

Here's a 2020 Q1 tax calendar with some of the key tax-related deadlines affecting businesses and other employers. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact me to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January 31 File 2019 Forms W-2, “Wage and Tax Statement,” with the Social Security Administration and provide copies to your employees. Provide copies of 2019 Forms 1099-MISC, “Miscellaneous Income,” to recipients of income from your business where required. File 2019 Forms 1099-MISC reporting nonemployee compensation payments in Box 7 with the IRS. File Form 940, “Employer’s Annual Federal Unemployment (FUTA) Tax Return,” for 2019. If your undeposited tax is $500 or less, you...

Given the escalating cost of employee health care benefits, your business may be interested in providing some of these benefits through an employer-sponsored Health Savings Account (HSA). For eligible individuals, setting up a Health Savings Account offers a tax-advantaged way to set aside funds (or have their employers do so) to meet future medical needs. Here are the key tax benefits: Contributions that participants make to an HSA are deductible, within limits. Contributions that employers make aren’t taxed to participants. Earnings on the funds within an HSA aren’t taxed, so the money can accumulate year after year tax free. HSA distributions to cover qualified medical expenses aren’t taxed. Employers don’t have to pay payroll taxes on HSA contributions made by employees through payroll deductions. Who is...

One of the most laborious tasks for small businesses is managing payroll. But it’s critical that you not only withhold the right amount of taxes from employees’ paychecks but also that you pay them over to the federal government on time. If you willfully fail to do so, you could personally be hit with Trust Fund Recovery Penalties, also known as the 100% penalty. The penalty applies to the Social Security and income taxes required to be withheld by a business from its employees’ wages. Since the taxes are considered property of the government, the employer holds them in “trust” on the government’s behalf until they’re paid over. The reason the penalty is sometimes called the “100% penalty” is because the person liable for the taxes (called...

Don’t let the holiday rush keep you from taking some important steps to cut your 2019 taxes. You still have time to execute a few strategies, including: Buying Assets Thinking about purchasing new or used heavy vehicles, heavy equipment, machinery or office equipment in the new year? Buy it and place it in service by December 31, and you can deduct 100% of the cost as bonus depreciation. Although “qualified improvement property” (QIP) — generally, interior improvements to nonresidential real property — doesn’t qualify for bonus depreciation, it’s eligible for §179 immediate expensing. And QIP now includes roofs, HVAC, fire protection systems, alarm systems and security systems placed in service after the building was placed in service. You can deduct as much as $1.02 million for QIP and other...

At this time of year, many business owners ask if there’s any year end tax saving tools they can implement. Under current tax law, there are two valuable depreciation-related tax breaks that may help your business reduce its 2019 tax liability. To benefit from these deductions, you must buy eligible machinery, equipment, furniture or other assets and place them into service by the end of the tax year. In other words, you can claim a full deduction for 2019 even if you acquire assets and place them in service during the last days of the year. The §179 deduction Under §179, you can deduct (or expense) up to 100% of the cost of qualifying assets in Year 1 instead of depreciating the cost over a number of...

The right entity choice can make a difference in the tax bill you owe for your business. Although S corporations can provide substantial tax advantages over C corporations in some circumstances, there are plenty of potentially expensive tax problems that you should assess before making the decision to initiate a C to S corporation conversion. Here’s a quick rundown of four issues to consider: (1) LIFO inventories C corporations that use last-in, first-out (LIFO) inventories must pay tax on the benefits they derived by using LIFO if they convert to S corporations. The tax can be spread over four years. This cost must be weighed against the potential tax gains from converting to S status. (2) Built-in gains tax Although S corporations generally aren’t subject to tax, those that were...

With Thanksgiving behind us, the holiday season is in full swing. At this time of year, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties. It’s a good idea to understand the tax rules associated with these expenses. Holiday parties provide tax breaks. Employee/client gifts may also be tax deductible by your business, but is the value taxable to the recipients? Customer and client gifts If you make gifts to customers and clients, the gifts are deductible up to $25 per recipient per year. For purposes of the $25 limit, you don’t need to include “incidental” costs that don’t substantially add to the gift’s value, such as engraving, gift wrapping, packaging or shipping. Also excluded from...

Is your business depreciating over a 30-year period the entire cost of constructing the building that houses your operation? If so, you should consider a cost segregation study. It may allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow. And under current law, the potential benefits of cost segregation studies are now even greater than they were a few years ago due to enhancements to certain depreciation-related tax breaks. Depreciation basics Business buildings generally have a 39-year depreciation period (27.5 years for residential rental properties). Most times, you depreciate a building’s structural components, including walls, windows, HVAC systems, elevators, plumbing and wiring, along with the building. Personal property — such as equipment, machinery, furniture and fixtures — is eligible for...

As an employer, you must pay federal unemployment (FUTA) tax on amounts up to $7,000 paid to each employee as wages during the calendar year. The rate of tax imposed is 6% but can be reduced by a credit (described below). Most employers end up paying an effective FUTA tax rate of 0.6%. An employer taxed at a 6% rate would pay FUTA tax of $420 for each employee who earned at least $7,000 per year, while an employer taxed at 0.6% pays $42. That said, what are you doing toward controlling unemployment tax costs of your business? Tax credit Unlike FICA taxes, only employers — and not employees — are liable for FUTA tax. Most employers pay both federal and a state unemployment tax. Unemployment tax...