If you own your own company and travel for business, you may wonder whether you can deduct the costs of having your spouse accompany you on trips. The rules for deducting a spouse’s travel costs are very restrictive. First of all, to qualify, your spouse must be your employee. This means you can’t deduct the travel costs of a spouse, even if his or her presence has a bona fide business purpose, unless the spouse is a bona fide employee of your business. This requirement prevents tax deductibility in most cases. A spouse-employee If your spouse is your employee, then you can deduct his or her travel costs if his or her presence on the trip serves a bona fide business purpose. Merely having your spouse perform some...

Do you want to withdraw cash from your closely held corporation at a minimum tax cost? The simplest way is to distribute cash as a dividend. However, a dividend distribution isn’t tax-efficient since it’s taxable to you to the extent of your corporation’s “earnings and profits.” It’s also not deductible by the corporation. Five alternatives Fortunately, there are several alternative methods that may allow you to withdraw cash from a corporation while avoiding dividend treatment. Here are five areas where you may want to take action: 1. Capital repayments. To the extent that you’ve capitalized the corporation with debt, including amounts you’ve advanced to the business, the corporation can repay the debt without the repayment being treated as a dividend. Additionally, interest paid on the debt can be...

If you’re in business for yourself as a sole proprietor, or you’re planning to start a business, you need to know about the tax aspects of your venture. Here are eight important issues to consider: 1. You report income and expenses on Schedule C of Form 1040. The net income is taxable to you regardless of whether you withdraw cash from the business. Your business expenses are deductible against gross income and not as itemized deductions. If you have any losses, they’re generally deductible against your other income, subject to special rules relating to hobby losses, passive activity losses and losses in activities in which you weren’t “at risk.” 2. You may be eligible for the pass-through deduction. To the extent your business generates qualified business income,...

While some businesses have closed since the start of the COVID-19 crisis, many new ventures have launched. Entrepreneurs have cited a number of reasons why they decided to start a business in the midst of a pandemic. For example, they had more time, wanted to take advantage of new opportunities or they needed money due to being laid off. Whatever the reason, if you’ve recently started a new business, or you’re contemplating starting one, be aware of the tax implications. As you know, before you even open the doors in a start-up business, you generally have to spend a lot of money. You may have to train workers and pay for rent, utilities, marketing and more. Entrepreneurs are often unaware that many expenses incurred by start-ups can’t...

Many tax limits that affect businesses are annually indexed for inflation, and a number of them have increased for 2022. Here’s a rundown of those that may be important to you and your business. Social Security tax The amount of an employee’s earnings that is subject to Social Security tax is capped for 2022 at $147,000 (up from $142,800 in 2021). Deductions Standard business mileage rate, per mile: 58.5 cents (up from 56 cents in 2021) Section 179 expensing: Limit: $1.08 million (up from $1.05 million in 2021) Phaseout: $2.7 million (up from $2.62 million) Income-based phase-out for certain limits on the Sec. 199A qualified business income deduction begins at: Married filing jointly: $340,100 (up from $329,800 in 2021) Single filers: $170,050 (up from $164,900) Business meals In 2022 and...

If you’re an employer with a business where tipping is customary for providing food and beverages, you may qualify for a federal tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income. Basics of the credit The FICA credit applies with respect to tips that your employees receive from customers in connection with the provision of food or beverages, regardless of whether the food or beverages are for consumption on or off the premises. Although these tips are paid by customers, they’re treated for FICA tax purposes as if you paid them to your employees. Your employees are required to report their tips to you. You must withhold and remit the employee’s share of FICA taxes, and you must...

Do you want to sell commercial or investment real estate that has appreciated significantly? One way to defer a tax bill on the gain is with a §1031 “like-kind” exchange where you exchange the property rather than sell it. With real estate prices up in some markets (and higher resulting tax bills), the like-kind exchange strategy may be attractive. A like-kind exchange is any exchange of real property held for investment or for productive use in your trade or business (relinquished property) for like-kind investment, trade or business real property (replacement property). For these purposes, like-kind is broadly defined, and most real property is considered to be like-kind with other real property. However, neither the relinquished property nor the replacement property can be real property held primarily...

After two years of no increases, the optional standard mileage rate used to calculate the deductible cost of operating an automobile for business will be going up in 2022 by 2.5 cents per mile. The IRS recently announced that the cents-per-mile rate for the business use of a car, van, pickup or panel truck will be 58.5 cents (up from 56 cents for 2021). The increased tax deduction partly reflects the price of gasoline. On December 21, 2021, the national average price of a gallon of regular gas was $3.29, compared with $2.22 a year earlier, according to AAA Gas Prices. Don’t want to keep track of actual expenses? Businesses can generally deduct the actual expenses attributable to business use of vehicles. This includes gas, oil, tires, insurance, repairs,...

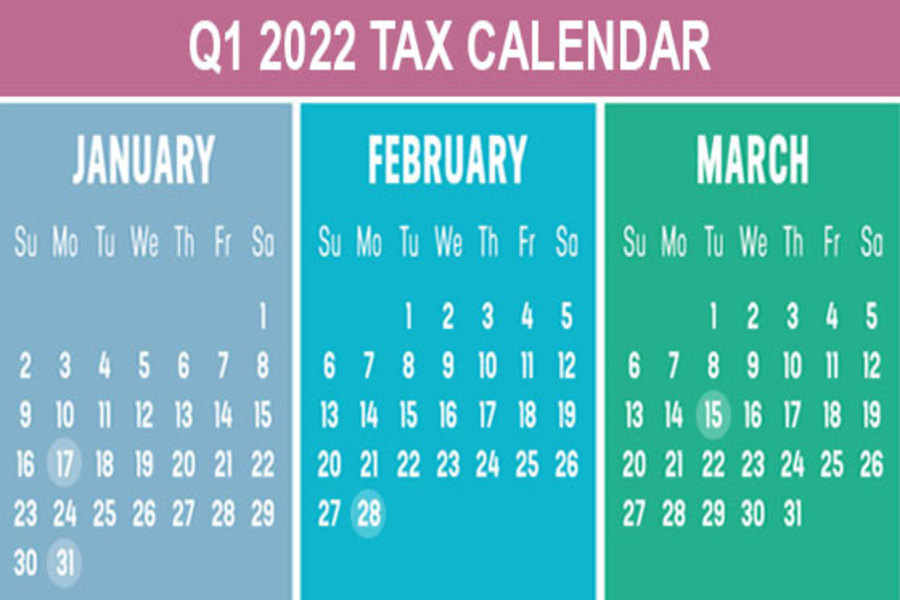

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January 17 (The usual deadline of January 15 is a Saturday) Pay the final installment of 2021 estimated tax. Farmers and fishermen: Pay estimated tax for 2021. January 31 File 2021 Forms W-2, “Wage and Tax Statement,” with the Social Security Administration and provide copies to your employees. Provide copies of 2021 Forms 1099-MISC, “Miscellaneous Income,” to recipients of income from your business where required. File 2021 Forms 1099-MISC, reporting nonemployee compensation payments...

The use of a company vehicle is a valuable fringe benefit for owners and employees of small businesses. This perk results in tax deductions for the employer as well as tax breaks for the owners and employees using the cars. (And of course, they get the non-tax benefit of getting a company car.) Plus, current tax law and IRS rules make the benefit even better than it was in the past. The rules in action Let’s say you’re the owner-employee of a corporation that’s going to provide you with a company car. You need the car to visit customers, meet with vendors and check on suppliers. You expect to drive the car 8,500 miles a year for business. You also expect to use the car for about...