If your business is successful and you do a lot of business travel, you may have considered buying a corporate aircraft. Of course, there are tax and non-tax implications for aircraft ownership. Let’s look at the basic tax rules. Business travel only In most cases, if your company buys a plane used only for business, the company can deduct its entire cost in the year that it’s placed into service. The cases in which the aircraft is ineligible for this immediate write-off are: The few instances in which neither the 100% bonus depreciation rules nor the §179 small business expensing rules apply or When the taxpayer has elected out of 100% bonus depreciation and hasn’t made the election to apply §179 expensing. In those cases, the depreciation schedule...

Don’t let the holiday rush keep you from considering some important steps to reduce your 2021 tax liability. You still have time to execute a few strategies. Purchase assets Thinking about buying new or used equipment, machinery or office equipment in the new year? Buy them and place them in service by December 31, and you can deduct 100% of the cost as bonus depreciation. Contact us for details on the 100% bonus depreciation break and exactly what types of assets qualify. Bonus depreciation is also available for certain building improvements. Before the 2017 Tax Cuts and Jobs Act (TCJA), bonus depreciation was available for two types of real property: land improvements other than buildings (for example fencing and parking lots), and “qualified improvement property,” a broad category of...

The Employee Retention Tax Credit (ERTC) was a valuable tax credit that helped employers survive the COVID-19 pandemic. A new law has retroactively terminated it before it was scheduled to end. It now only applies through September 30, 2021 (rather than through December 31, 2021) — unless the employer is a “recovery startup business.” The Infrastructure Investment and Jobs Act of 2021 (IIJA 2021), which was signed by President Biden on November 15, 2021, doesn’t have many tax provisions but this one is important for some businesses. If you anticipated receiving the ERTC based on payroll taxes after September 30 and retained payroll taxes, you must determine how and when to repay those taxes and address any other compliance issues. The American Institute of Certified Public Accountants (AICPA)...

Recent pass-through entity (PTE) tax (AB-150) clarifications from the Franchise Tax Board (FTB) underscore that detailed planning is critical when considering this credit. For an overview of AB-150, also see our initial 8/15/21 post on this subject: "California AB-150 Provides SALT Cap Workaround". PTE Election The election to pay the tax is: made annually, is irrevocable, and can only be made on an original, timely filed return, including extensions PTE Tax Due Date (2021 Tax Year) For the initial year the PTE tax credit concepts exists (2021) the tax is due by original due date of the 2021 tax year return, without regard to extensions. For calendar-year taxpayers, that is March 15, 2022. Logistics of PTE Tax Payments / K-1 Recipient Credits Prior to the original due date of the tax...

The holiday season will soon be here. At this time of year, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties again after a year of forgoing them due to the pandemic. It’s a good time to brush up on the tax rules associated with these expenses. Are they tax deductible by your business and is the value taxable to the recipients? Gifts to customers If you give gifts to customers and clients, they’re deductible up to $25 per recipient per year. For purposes of the $25 limit, you don’t need to include “incidental” costs that don’t substantially add to the gift’s value. These costs include engraving, gift wrapping, packaging and shipping. Also excluded from the...

Are you planning to launch a business or thinking about changing your business entity? If so, you need to determine which entity will work best for you — a C corporation or a pass-through entity such as a sole-proprietorship, partnership, limited liability company (LLC) or S corporation. There are many factors to consider and proposed federal tax law changes being considered by Congress may affect your decision. The corporate federal income tax is currently imposed at a flat 21% rate, while the current individual federal income tax rates begin at 10% and go up to 37%. The difference in rates can be mitigated by the qualified business income (QBI) deduction that’s available to eligible pass-through entity owners that are individuals, estates and trusts. Note that non-corporate taxpayers...

With the increasing cost of employee health care benefits, your business may be interested in providing some of these benefits through an employer-sponsored Health Savings Account (HSA). For eligible individuals, an HSA offers a tax-advantaged way to set aside funds (or have their employers do so) to meet future medical needs. Here are the important tax benefits: Contributions that participants make to an HSA are deductible, within limits. Contributions that employers make aren’t taxed to participants. Earnings on the funds in an HSA aren’t taxed, so the money can accumulate tax free year after year. Distributions from HSAs to cover qualified medical expenses aren’t taxed. Employers don’t have to pay payroll taxes on HSA contributions made by employees through payroll deductions. Eligibility rules To be eligible for...

If your business is depreciating over a 30-year period the entire cost of constructing the building that houses your operation, you should consider a cost segregation study. It might allow you to accelerate depreciation deductions on certain items, thereby reducing taxes and boosting cash flow. And under current law, the potential benefits of a cost segregation study are now even greater than they were a few years ago due to enhancements to certain depreciation-related tax breaks. Fundamentals of depreciation Generally, business buildings have a 39-year depreciation period (27.5 years for residential rental properties). Usually, you depreciate a building’s structural components, including walls, windows, HVAC systems, elevators, plumbing and wiring, along with the building. Personal property — such as equipment, machinery, furniture and fixtures — is eligible for...

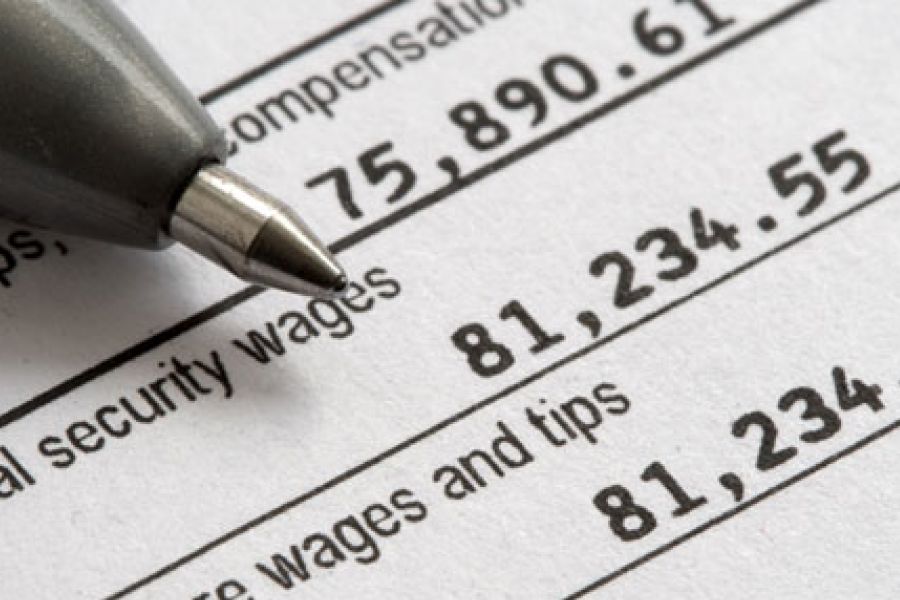

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $147,000 for 2022 (up from $142,800 for 2021). Wages and self-employment income above this threshold aren’t subject to Social Security tax. Background information The Federal Insurance Contributions Act (FICA) imposes two taxes on employers, employees and self-employed workers — one for Old Age, Survivors and Disability Insurance, which is commonly known as the Social Security tax, and the other for Hospital Insurance, which is commonly known as the Medicare tax. There’s a maximum amount of compensation subject to the Social Security tax, but no maximum for Medicare tax. For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as...

Background Businesses are having difficulties hiring an adequate number of employees as the economy resets after the COVID-19 lockdowns and their aftermath. As such, small businesses are having to think outside the box as they work toward locating amenable workers. If your small business hires a "targeted group" member, you are afforded the ability to claim the lucrative federal Work Opportunity Tax Credit (WOTC) for a portion of wages paid to such an individual. CAA 2021 Changes Within the Consolidated Appropriations Act of 2021 (signed into law on 12/27/20) was the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTRA 2020). TCDTRA 2020 extended the WOTC to cover qualified first-year wages paid to eligible new hires who begin work by 12/31/25. This means that the hiring and paying...