Are employees at your business traveling again after months of virtual meetings? In Notice 2021-52, the IRS announced the fiscal 2022 “per diem” rates that became effective October 1, 2021. Taxpayers can use these rates to substantiate the amount of expenses for lodging, meals and incidental expenses when traveling away from home. (Taxpayers in the transportation industry can use a special transportation industry rate.) Background information A simplified alternative to tracking actual business travel expenses is to use the high-low per diem method. This method provides fixed travel per diems. The amounts are based on rates set by the IRS that vary from locality to locality. Under the high-low method, the IRS establishes an annual flat rate for certain areas with higher costs of living. All locations within the...

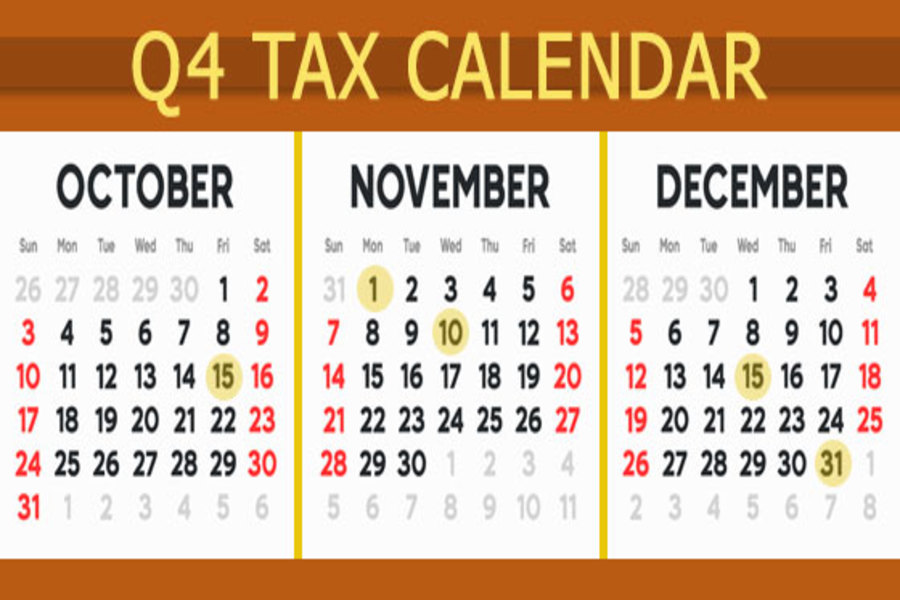

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have a business in federally declared disaster areas. Friday, October 15 If a calendar-year C corporation that filed an automatic six-month extension: File a 2020 income tax return (Form 1120) and pay any tax, interest and penalties due. Make contributions for 2020 to certain employer-sponsored retirement plans. Monday, November 1 Report income tax withholding and FICA taxes for third...

Low interest rates and other factors have caused global merger and acquisition (M&A) activity to reach new highs in 2021, according to Refinitiv, a provider of financial data. It reports that 2021 is set to be the biggest in M&A history, with the United States accounting for $2.14 trillion worth of transactions already this year. If you’re considering buying or selling a business — or you’re in the process of an M&A transaction — it’s important that both parties report it to the IRS and state agencies in the same way. Otherwise, you may increase your chances of being audited. If a sale involves business assets (as opposed to stock or ownership interests), the buyer and the seller must generally report to the IRS the purchase...

If you use an automobile in your trade or business, you may wonder how depreciation tax deductions are determined. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include many pickups and SUVs) can result in it taking longer than expected to fully depreciate a vehicle. Cents-per-mile vs. actual expenses First, note that separate depreciation calculations for a passenger auto only come into play if you choose to use the actual expense method to calculate deductions. If, instead, you use the standard mileage rate (56 cents per business mile driven for 2021), a depreciation allowance is built into the rate. If you use the actual expense method to determine your allowable deductions for a passenger auto, you must make a separate depreciation...

California Assembly Bill No. 50 (AB-50) established the California Main Street Small Business Tax Credit II, which will provide COVID-19 financial relief to qualified small business employers. Overview Beginning 11/1/21, and ending 11/30/21, the California Department of Tax and Fee Administration (CDTFA) will be accepting applications through their online reservation system for qualified small business employers to reserve $1,000 per net increase in qualified employees, not to exceed $150,000. Tentative credit reservation amounts will generally be reduced by credit amounts reserved or received under the first Main St. Small Business Tax Credit. The credits are reserved on a first-come, first-served basis. Qualified small businesses will be able to offset either their income taxes or their sales and use taxes with the credit when filing their returns. Qualifications This credit...

A business may be able to claim a federal income tax deduction for a theft loss. But does embezzlement count as theft? In most cases it does but you’ll have to substantiate the loss. A recent U.S. Tax Court decision illustrates how that’s sometimes difficult to do. Basic rules for theft losses The tax code allows a deduction for losses sustained during the taxable year and not compensated by insurance or other means. The term “theft” is broadly defined to include larceny, embezzlement and robbery. In general, a loss is regarded as arising from theft only if there’s a criminal element to the appropriation of a taxpayer’s property. In order to claim a theft loss deduction, a taxpayer must prove: The amount of the loss, The date the...

The week of September 13-17 has been declared National Small Business Week by the Small Business Administration. To commemorate the week, here are three tax breaks to consider. 1. Claim bonus depreciation or a §179 deduction for asset additions Under current law, 100% first-year bonus depreciation is available for qualified new and used property that’s acquired and placed in service in calendar year 2021. That means your business might be able to write off the entire cost of some or all asset additions on this year’s return. Consider making acquisitions between now and December 31. Note: It doesn’t always make sense to claim a 100% bonus depreciation deduction in the first year that qualifying property is placed in service. For example, if you think that tax rates will...

In order to prepare for a business audit, an IRS examiner generally does research about the specific industry and issues on the taxpayer’s return. Examiners may use IRS “Audit Techniques Guides (ATGs).” A little-known secret is that these guides are available to the public on the IRS website. In other words, your business can use the same guides to gain insight into what IRS auditors know, and what the IRS is looking for in terms of compliance with tax laws and regulations. Many ATGs target specific industries or businesses, such as new vehicle dealerships, construction, aerospace, art galleries, architecture and veterinary medicine. Others address issues that frequently arise in audits, such as executive compensation, passive activity losses and capitalization of tangible property. Unique issues IRS auditors need to...

If you’re a business owner and you’re getting a divorce, tax issues can complicate matters. Your business ownership interest is one of your biggest personal assets and in many cases, your marital property will include all or part of it. Tax-free property transfers You can generally divide most assets, including cash and business ownership interests, between you and your soon-to-be ex-spouse without any federal income or gift tax consequences. When an asset falls under this tax-free transfer rule, the spouse who receives the asset takes over its existing tax basis (for tax gain or loss purposes) and its existing holding period (for short-term or long-term holding period purposes). Let’s say that under the terms of your divorce agreement, you give your house to your spouse in exchange for...

What if you decide to, or are asked to, guarantee a loan to your corporation? Before agreeing to act as a guarantor, endorser or indemnitor of a debt obligation of your closely held corporation, be aware of the possible tax consequences. If your corporation defaults on the loan and you’re required to pay principal or interest under the guarantee agreement, you don’t want to be blindsided. Business vs. non-business If you’re compelled to make good on the obligation, the payment of principal or interest in discharge of the obligation generally results in a bad debt deduction. This may be either a business or a non-business bad debt deduction. If it’s a business bad debt, it’s deductible against ordinary income. A business bad debt can be either totally...