As posted on the PBS NewsHour YouTube Channel on 5/23/14 PBS NewsHour economics correspondent Paul Solman speaks with former pharmaceutical executive Chris Martenson, who now lives in rural Massachusetts, about exponential growth and the danger of rising debt. “We have an economy that’s based on growth. We want it to grow all the time. Not a lot . . . 3% real, maybe 5% nominal growth. We’d like jobs to grow . . . we’d like to see more auto sales next year . . . more houses sold . . . and it’s always on a percentage basis. Whenever anything is growing by some percent amount over a unit of time, it takes a characteristic curve shape. It’s not a straight line. It takes off so-to-say,...

"The Global Dollar Standard was Put in Place by a Series of Accidental Events that were Very Fortunate for the United States Because it Gave Us an Advantage over the Rest of the World" As posted to the GoldSilver YouTube Channel on 9/24/2013 You may have heard stories on the news lately that suggest an international move away from the US Dollar is underway...

As posted to the Naomi Brockwell You Tube Channel on 2/10/18 Naomi Brockwell sits down with Dr. Ron Paul at the recent Satoshi Roundtable in Cancun to discuss the importance of cryptocurrency. Dr. Paul has championed the concept of having a currency that the government can't control long before the advent of cryptocurrencies. He references Nobel laureate F. A. Hayek's proposal about competing currencies and de-nationalizing money . . . the fact that money came about naturally . . . that governments took it over and monopolized it . . . and that he would like to see the legal tender laws reversed. Dr. Ron Paul is an American author, physician, and former politician. He is a 12 term U.S. Congressman and 3 time presidential candidate. Since retiring...

As posted to the Harry S. Dent, Jr. You Tube Channel on 1/26/18 https://youtu.be/_NyXg2egGds Harry Dent takes a look back at what we saw play out in 2017 . . . and uses his trademark "cycle analysis" to look ahead to what 2018 will have in store for the markets, currencies and industries across the board. Harry S. Dent, Jr. is the founder of Dent Research, an economic forecasting and investment research firm and publisher that works diligently to provide clients with the proprietary economic knowledge needed to accurately forecast what lies ahead in our economy so that they can take the necessary and appropriate action to ensure prosperity in their business, investment and financial affairs....

"Monetary History Repeats Over and Over Again Echoing Back to the Beginnings of Civilization" As posted to the GoldSilver YouTube Channel on 8/13/2013 In this, the second installment of the popular "Hidden Secrets of Money" docu-series, Mike Maloney travels to Greece to learn when, where and why currency became money. Also revealed is one of the most predictable long term economic cycles - the Seven Stages Of Empire. Finally, join Mike at a private meeting in London where he lets you connect the dots of the seven stages across the last 140 years of our own monetary history. Michael Maloney, founder of www.GoldSilver.com is also the author of the world’s best selling book on precious metals investing. Since 2003 he has been advocating gold and silver as the ultimate means of protecting wealth from the...

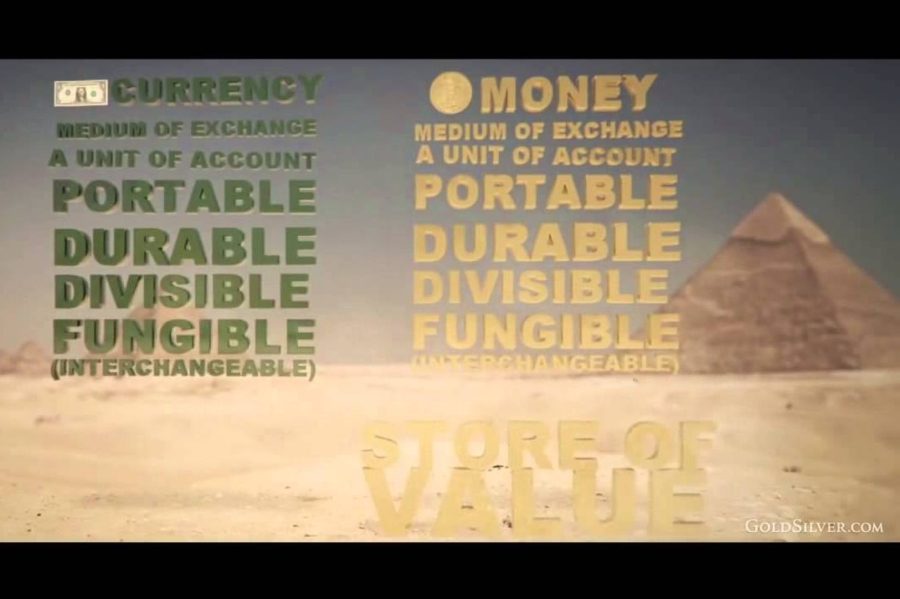

Terms Seemingly Used Interchangeably, What is the Difference? As posted to the GoldSilver YouTube Channel on 2/26/2013 https://youtu.be/DyV0OfU3-FU In this, the first installment of the popular "Hidden Secrets of Money" docu-series, Mike Maloney travels to Egypt to unravel the difference between money and currency. Many people have been led to believe they are the same thing, a misconception that could have dire consequences in the near future. Arguably one of the most important lessons you will ever learn, grasping this concept will pave the way for your understanding of future episodes. Michael Maloney, founder of www.GoldSilver.com is also the author of the world’s best selling book on precious metals investing. Since 2003 he has been advocating gold and silver as the ultimate means of protecting wealth from the games played by our governments...

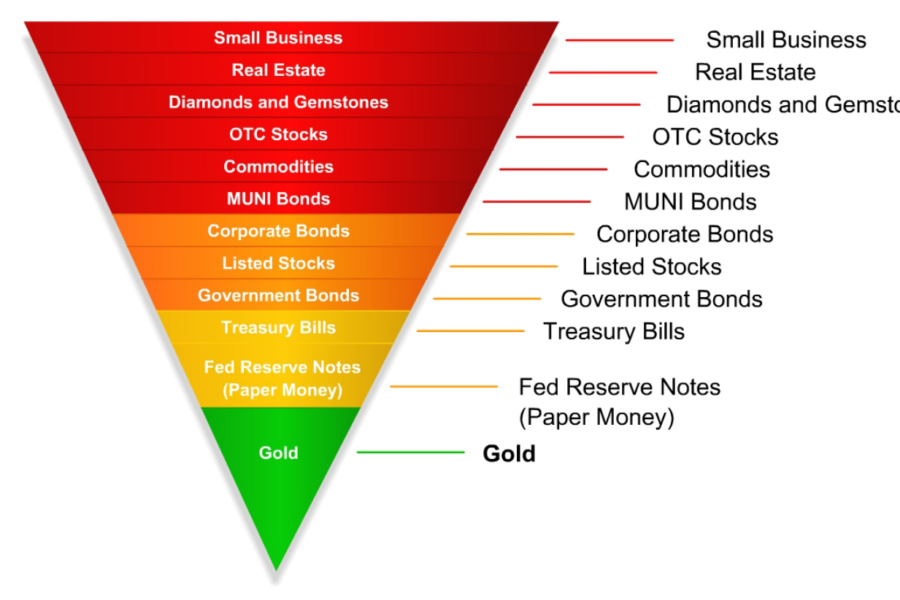

In What Order will Asset Values Fail in the Next Financial Crisis? As posted to LesJones.com on September 9, 2009 Reproduced from the article: "Word of the Day: Exter's Inverted Pyramid of Assets" John Exter’s inverted pyramid. The idea is that things high on the pyramid are derivatives of asset classes further down the pyramid. From FOFOA. Note that in FOFOA’s expanded version of Exter’s inverted pyramid there are all sorts of derivatives at the top of the inverse pyramid. Those derivatives were wildly inflated and at one pointed passed the one quadrillion mark, which is greater than the value of all physical, privately-owned assets on Earth. How is that possible? It’s possible because derivatives and paper markets are often larger than the underlying physical markets. In a nutshell, the...

Lesson: Leave all Creative Energies Uninhibited As released by the Competitive Enterprise Institute (CEI) in November 2012 https://youtu.be/IYO3tOqDISE In November 2012, the Competitive Enterprise Institute (CEI) released I, Pencil: The Movie, an animated short film adapted from the 1958 essay by Leonard E. Read. Do you know how to make a pencil? You don’t, do you? As Read explained in his classic essay, no single person on earth does. The pencil, like most modern wonders, is the end product of an intricate chain of human activity that spans the globe. There is no mastermind dictating the making of a pencil; not even the CEO of a pencil company could tell you exactly how to make one. It takes little bits of know-how of thousands of individuals—loggers in California, factory...

An explanation of the current state of the economy As appearing on the libertyordeath TV's YouTube Channel Business cycle theory is an economic theory developed by the Austrian School of economics about how business cycles occur. The theory views business cycles as the consequence of excessive growth in bank credit, due to artificially low interest rates set by a central bank or fractional reserve banks. The Austrian business cycle theory originated in the work of Austrian School economists Ludwig von Mises and Friedrich Hayek. Hayek won the Nobel Prize in economics in 1974 (shared with Gunnar Myrdal) in part for his work on this theory. Proponents believe that a sustained period of low interest rates and excessive credit creation result in a volatile and unstable imbalance between...

The United States Monetary System Explained As posted on the Mike Maloney You Tube Channel on 10/15/13\ https://youtu.be/iFDe5kUUyT0 Who owns the Federal Reserve? You are about to learn one of the biggest secrets in the history of the world . . . it's a secret that has huge effects for everyone who lives on this planet. Most people can feel deep down that something isn't quite right with the world economy, but few know what it is. Blog Post #226 represents the re-launch of my blog which originally started in 2008. I wanted to start out with a bang, and this clip certainly fills the bill. #4 in Mike Maloney's popular "Hidden Secrets of Money" series explains what is in effect the root of all of the country's (and...