Peter Schiff appears on RT on 10/16/18 to discuss the need to reduce government spending. Peter explains that people overlook the increase in the National Debt in that, although the official Budget Deficit is $780B, the National Debt increased by $1.2T during the same time period. That, Peter goes on to explain, is because a lot of what the government is borrowing, it doesn't count as part of the official budget . . . "so it actually borrows about 60% more than it is pretending to borrow". Peter Schiff is an American stock broker, financial commentator, and radio personality. He is CEO and chief global strategist of Euro Pacific Capital Inc., a broker-dealer based in Westport, Connecticut. He is also the author of six books published by John Wiley & Sons. His book, Crash Proof 2.0, appeared on...

As posted to the David Stockman YouTube Channel on 10/22/18 David Stockman appears on Fox Business Network's "Varney & Co." to discuss the impact of the Federal Reserve's decision to drain $600B out of the bond market and, in turn, the economy. Stockman explains that the Fed will accomplish this by allowing their balance sheet, which reached $4.5T, to shrink by not reinvesting when Treasury Bonds mature . . . which is the same thing as selling bonds. Stockman goes on to say that adding $600B of debt to the $1.2T budget deficit that we already have for this year, means that $1.8T of debt is looking for a home in the bond market. It will find a home, but not at 3.2% yield on the 10...

We’re all aware that the Fed is raising short-term rates. But, as Rodney Johnson, co-editor of Boom & Bust, points out in this month’s Insight video, they’re doing something more important than that . . . (This is not an embedded clip. Ctrl+Click picture above to link to clip location) Rodney Johnson is the co-founder of Dent Research, an economic forecasting and investment research firm and publisher that works diligently to provide clients with the proprietary economic knowledge needed to accurately forecast what lies ahead in our economy so that they can take the necessary and appropriate action to ensure prosperity in their business, investment and financial affairs....

Jim Rickards pulls no punches about his opinion of Bitcoin and it's prospects for the future in a collage of television appearances from 2009 - 2018. James G. Rickards is an American lawyer. He is a regular commentator on finance, and is the author of The New York Times bestseller Currency Wars: The Making of the Next Global Crisis, published in 2011 as well as biennial followup books, James Rickards is the Editor of Strategic Intelligence, a financial newsletter, and Director of The James Rickards Project, an inquiry into the complex dynamics of geopolitics + global capital....

As posted to the David Stockman YouTube Channel on 9/15/18 (David Stockman starts at time marker 0:47) David Stockman is interviewed at the 2018 Sprott Natural Resource Symposium to discuss the great $20 Trillion elephant in the room which he explains is the Balance Sheets of all of the Central Banks of the world "in excess of what it probably should be in a rational, stable, historically prudent world". David Stockman is a former businessman and U.S. politician who served as a Republican U.S. Representative from the state of Michigan and as the Director of the Office of Management and Budget under President Ronald Reagan. He is the author of a number of books including "The Great Deformation: The Corruption of Capitalism in America" and, most recently, "Trumped!...

The Facebook scandal involving personal data mishandled by Cambridge Analytica has raised concerns over the privacy of the information we share on our social media accounts. Some countries have gone as far as to legislate Internet data privacy with laws granting the “right to be forgotten.” Yet Facebook CEO Mark Zuckerberg says we don’t need such regulations here in the states. Is he right? And though California has been a leader in privacy, the last meaningful update to the state’s privacy laws was in the 1980s, long before today’s technology. Investigative journalist Ben Swann provides a "Reality Check". Ben Swann is an Emmy winning American television news anchor and investigative journalist who most recently worked at CBS affiliate WGCL-TV in Atlanta, Georgia as chief evening news anchor from 2015 to 2018. His...

As posted to the Harry S. Dent, Jr. You Tube Channel on 1/26/18 https://youtu.be/_NyXg2egGds Harry Dent takes a look back at what we saw play out in 2017 . . . and uses his trademark "cycle analysis" to look ahead to what 2018 will have in store for the markets, currencies and industries across the board. Harry S. Dent, Jr. is the founder of Dent Research, an economic forecasting and investment research firm and publisher that works diligently to provide clients with the proprietary economic knowledge needed to accurately forecast what lies ahead in our economy so that they can take the necessary and appropriate action to ensure prosperity in their business, investment and financial affairs....

Doug Casey Believes that Cryptocurrencies will Help Spur Demand for Gold As posted by Kitco News on 11/24/17 Bitcoin and gold were the highlights of this year’s Silver & Gold Summit in San Francisco (November 20-21, 2017), and to best-selling author Doug Casey, cryptocurrencies is the asset class to watch. “I’m very, very pro cryptocurrencies,” he told Kitco News on the sidelines of the event. But the longtime investor is not giving up on gold. Rather, he believes cryptocurrencies like Bitcoin will help spur demand for the yellow metal. “[Bitcoin] is a fiat currency created out of nothing . . . like the Dollar. As people move into more and more electronic currencies . . . the government is currently trying to get rid of $100, $50,...

Debt Ceiling Holiday Ends 3/15/17 As posted to Greg Hunter's USA Watchdog YouTube Channel on February 25, 2017 Former White House Budget Director David Stockman drops a bomb in his latest interview by saying, “I think what people are missing is this date, March 15th 2017. That’s the day that this debt ceiling holiday that Obama and Boehner put together right before the last election in October of 2015. That holiday expires. The debt ceiling will freeze in at $20 trillion. It will then be law. It will be a hard stop. The Treasury will have roughly $200 billion in cash. We are burning cash at a $75 billion a month rate. By summer, they will be out of cash. Then we will be in the mother...

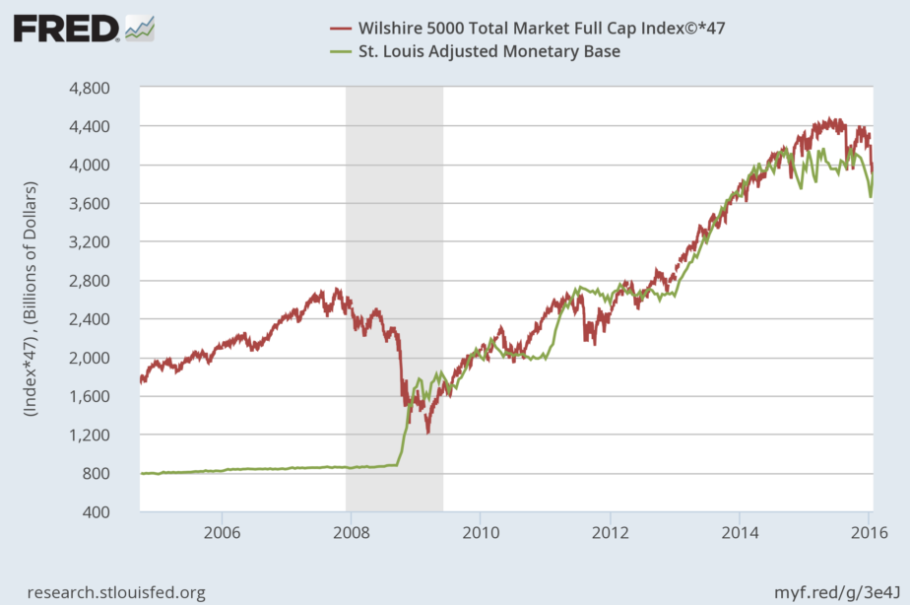

The Stock Market is Exactly Mirroring Base Money As posted to the GoldSilver You Tube Channel on 7/21/16 https://youtu.be/U1RlJuJ9hAw What's behind the recent market rally? In this video, Mike shows you how the market is being pumped up to record highs, (Hint: it's not individual investors doing the buying) and the telltale sign a disaster is in the making. “The stock market will be in for a much bigger plunge than we’ve seen the past couple of times…” -- Mike Maloney Michael Maloney, founder of www.GoldSilver.com is also the author of the world's best selling book on precious metals investing. Since 2003 he has been advocating gold and silver as the ultimate means of protecting wealth from the games played by our governments and banking sector....