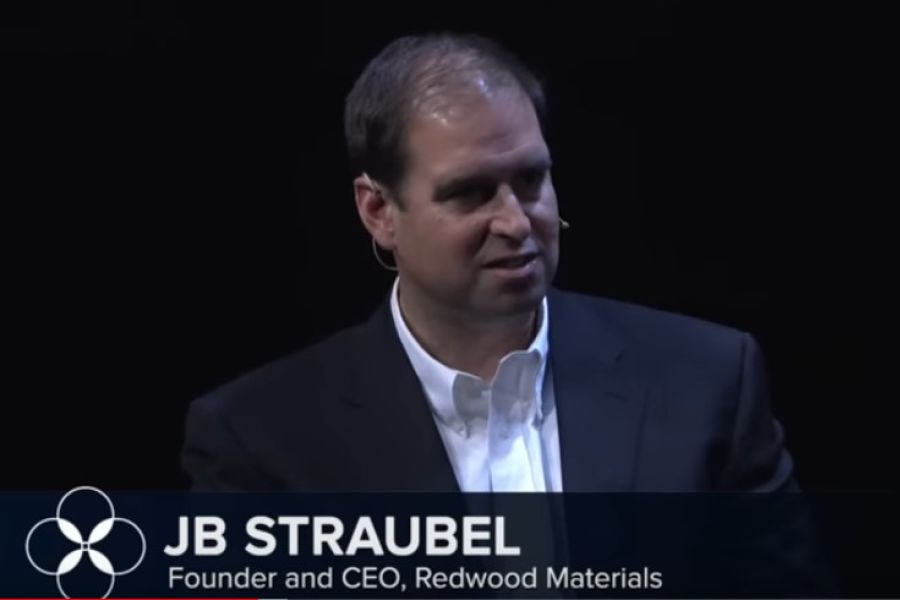

As posted to the Climate One YouTube page on 7/17/23 Run Time 58 minutes, 47 seconds (when beginning at Time Stamp 21:33) Climate One clip description: Demand for lithium ion batteries is expected to grow 500% by 2030, and the race for raw materials is on. Lithium mines around the world are opening or expanding, while children as young as six in the Congo carry sacks of cobalt-laced rocks on their backs for less than $2 a day. Recycling presents promising opportunities, yet before millions of batteries can be recycled, they have to be made in the first place. At the same time, advances in battery chemistry continue to be made, and it’s not hard to imagine a near future when batteries don’t require lithium or cobalt at...

As posted to the Engineering Explained YouTube Channel on 12/23/2022 (Run Time 11 min, 45 sec) Electric cars place unique challenges on tires, as a result of four key characteristics: weight, efficiency, noise, and torque. Thanks to asking Hankook's engineers an abundance of questions, John Fenske has got all the answers on how electric car tires can help EVs overcome these challenges. (This is Blog Post #1396) Jason Fenske is a graduated mechanical engineer with a passion for cars, and his goal is to help other people passionate about cars learn how they work. Check out his YouTube Channel here: www.youtube.com/@EngineeringExplained/about...

As posted to the AutoLine Network YouTube Channel on 4/8/2023 (Run Time 10 min, 25 sec) John McElroy presents his 2023 ranking of the top 12 automakers based on revenue, profits and several other factors. No editorializing . . . just the numbers. (This is Blog Post #1396) John McElroy has been called an influential thought leader in the automotive industry. He created “Autoline Daily,” the first industry webcast of industry news and analysis. He also hosts the Emmy Award-winning television program “Autoline This Week” and co-hosts “Autoline After Hours”, all of which can be found at www.autoline.tv....

Many businesses use independent contractors to help keep their costs down — especially in these times of staff shortages and inflationary pressures. If you’re among them, be careful that these workers are properly classified for federal tax purposes. If the IRS reclassifies them as employees, it can be an expensive mistake. The question of whether a worker is an independent contractor or an employee for federal income and employment tax purposes is a complex one. If a worker is an employee, your company must withhold federal income and payroll taxes and pay the employer’s share of FICA taxes on the wages, plus FUTA tax. A business may also provide the worker with fringe benefits if it makes them available to other employees. In addition, there may...

If you’re the owner of an incorporated business, you know there’s a tax advantage to taking money out of a C corporation as compensation rather than as dividends. The reason: A corporation can deduct the salaries and bonuses that it pays executives, but not dividend payments. Therefore, if funds are paid as dividends, they’re taxed twice, once to the corporation and once to the recipient. Money paid out as compensation is only taxed once — to the employee who receives it. However, there are limits to how much money you can take out of the corporation this way. Under tax law, compensation can be deducted only to the extent that it’s reasonable. Any unreasonable portion isn’t deductible and, if paid to a shareholder, may be taxed...

If you’re starting a business with some partners and wondering what type of entity to form, an S corporation may be the most suitable form of business for your new venture. Here are some of the reasons why. A big benefit of an S corporation over a partnership is that as S corporation shareholders, you won’t be personally liable for corporate debts. In order to receive this protection, it’s important that: The corporation be adequately financed, The existence of the corporation as a separate entity be maintained, and Various formalities required by your state be observed (for example, filing articles of incorporation, adopting by-laws, electing a board of directors and holding organizational meetings). Dealing with losses If you expect that the business will incur losses in its early years,...

Revenue Ruling 59-60 is a landmark piece of IRS guidance that outlines the factors to consider when estimating the fair market value of a private business. Here’s an overview of those factors, along with other hidden details found in the ruling’s fine print. 8-factor approach Revenue Ruling 59-60 says that business valuation is an inexact science, often resulting in “wide differences of opinion” about the value of a particular business interest. Therefore, valuation professionals use a customized approach that considers the following eight factors: 1. The nature and history of the subject company, 2. The outlook for the general economy and industry, 3. Book value and financial condition (from at least two years of balance sheets), 4. Earnings capacity (from at least five years of income statements), 5. Dividend-paying capacity (as opposed...

As reported in IR-2023-33 on 2/24/2023 Disaster-area taxpayers in most of California now have until October 16, 2023, to file various federal individual and business tax returns and make tax payments, the Internal Revenue Service announced last Friday. Previously, the deadline had been postponed to May 15, 2023 for these areas. The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA) in on the page entitled California Severe Winter Storms, Flooding, Landslides, and Mudslides. There are four different eligible FEMA declarations, and the start dates and other details vary for each of these disasters. The current list of eligible localities and other details for each disaster are always available on the Tax Relief in Disaster Situations page on IRS.gov. The additional relief postpones...

According to various sources, around 10% of all insurance claims involve fraud. Insurance companies generally pass along the cost of these fraud losses to policyholders in the form of higher premiums. Unfortunately, small businesses, which are generally less able to pay premium hikes, are particularly vulnerable to insurance fraud. To protect your company from losses and minimize the likelihood of increased premiums, learn how to identify insurance fraud. Areas of concern There are several forms of insurance fraud that could potentially affect your business: Workers’ compensation. In these schemes, an employee exaggerates or fabricates an injury or illness to receive workers’ compensation benefits. For example, a worker could mischaracterize an injury from a minor accident as serious or claim that an existing, non-work-related condition was the result of...

Two techniques fall under the income approach umbrella when valuing a private business interest: the discounted cash flow (DCF) method and the capitalization of earnings method. How do these two commonly used methods compare — and which one is appropriate for a specific investment? Fundamentals of discounting The DCF method estimates the present value of future expected net cash flows using a discount rate. It entails these basic steps: Compute future cash flows. Potential investors are generally trying to determine what’s in it for them in terms of cash flow and an acceptable return on investment. Historical earnings are often the starting point for estimating expected cash flow over a discrete discounting period of, say, five or seven years. Then, the valuation expert calculates a terminal (or residual)...