Recent pass-through entity (PTE) tax (AB-150) clarifications from the Franchise Tax Board (FTB) underscore that detailed planning is critical when considering this credit. For an overview of AB-150, also see our initial 8/15/21 post on this subject: "California AB-150 Provides SALT Cap Workaround". PTE Election The election to pay the tax is: made annually, is irrevocable, and can only be made on an original, timely filed return, including extensions PTE Tax Due Date (2021 Tax Year) For the initial year the PTE tax credit concepts exists (2021) the tax is due by original due date of the 2021 tax year return, without regard to extensions. For calendar-year taxpayers, that is March 15, 2022. Logistics of PTE Tax Payments / K-1 Recipient Credits Prior to the original due date of the tax...

Are you planning to launch a business or thinking about changing your business entity? If so, you need to determine which entity will work best for you — a C corporation or a pass-through entity such as a sole-proprietorship, partnership, limited liability company (LLC) or S corporation. There are many factors to consider and proposed federal tax law changes being considered by Congress may affect your decision. The corporate federal income tax is currently imposed at a flat 21% rate, while the current individual federal income tax rates begin at 10% and go up to 37%. The difference in rates can be mitigated by the qualified business income (QBI) deduction that’s available to eligible pass-through entity owners that are individuals, estates and trusts. Note that non-corporate taxpayers...

California Assembly Bill No. 50 (AB-50) established the California Main Street Small Business Tax Credit II, which will provide COVID-19 financial relief to qualified small business employers. Overview Beginning 11/1/21, and ending 11/30/21, the California Department of Tax and Fee Administration (CDTFA) will be accepting applications through their online reservation system for qualified small business employers to reserve $1,000 per net increase in qualified employees, not to exceed $150,000. Tentative credit reservation amounts will generally be reduced by credit amounts reserved or received under the first Main St. Small Business Tax Credit. The credits are reserved on a first-come, first-served basis. Qualified small businesses will be able to offset either their income taxes or their sales and use taxes with the credit when filing their returns. Qualifications This credit...

As posted to the John Stossel YouTube Channel on 6/1/21 Run time: (4 minutes, 30 seconds) Do you get frustrated when you’re the only car stopped at a traffic signal? John Stossel aims to show that roundabouts are a solution to that, and more. In an interview with Carmel, Indiana mayor Jim Brainard, the mayor explains that roundabouts are safer, they save lives, and they cost less . . . and to prove that he's put his money where his mouth . . . he's replaced nearly every stoplight in his town with a roundabout. That means that his town now accounts for about 2% of all roundabouts in America. "Roundabouts are safer." A study in Wisconsin found that when roundabouts replaced typical intersections, deaths fell 38%. Crashes...

In order to prepare for a business audit, an IRS examiner generally does research about the specific industry and issues on the taxpayer’s return. Examiners may use IRS “Audit Techniques Guides (ATGs).” A little-known secret is that these guides are available to the public on the IRS website. In other words, your business can use the same guides to gain insight into what IRS auditors know, and what the IRS is looking for in terms of compliance with tax laws and regulations. Many ATGs target specific industries or businesses, such as new vehicle dealerships, construction, aerospace, art galleries, architecture and veterinary medicine. Others address issues that frequently arise in audits, such as executive compensation, passive activity losses and capitalization of tangible property. Unique issues IRS auditors need to...

What if you decide to, or are asked to, guarantee a loan to your corporation? Before agreeing to act as a guarantor, endorser or indemnitor of a debt obligation of your closely held corporation, be aware of the possible tax consequences. If your corporation defaults on the loan and you’re required to pay principal or interest under the guarantee agreement, you don’t want to be blindsided. Business vs. non-business If you’re compelled to make good on the obligation, the payment of principal or interest in discharge of the obligation generally results in a bad debt deduction. This may be either a business or a non-business bad debt deduction. If it’s a business bad debt, it’s deductible against ordinary income. A business bad debt can be either totally...

As posted to the Lex Fridman YouTube Channel on 8/20/21 (Run Time: 11 min, 29 sec) "Tesla AI Day presented the most amazing real-world AI and Engineering effort I have ever seen in my life" -- Lex Fridman On 8/19/21, Elon Musk convened Tesla AI Day, an event to share progress in the automaker’s software and hardware development related to artificial intelligence. The sole purpose of the even was a recruiting platform for Tesla’s AI team. Lex Fridman, presents here a quick video on the main innovations presented at Tesla AI day. (This is Blog Post #1075) Lex Fridman is an AI researcher working on autonomous vehicles, human-robot interaction, and machine learning at MIT and beyond. You can find his MIT Deep Learning and Artificial Intelligence Lectures at deeplearning.mit.edu, and the...

While Congress develops legislation that would eliminate, and/or otherwise mitigate, the current TCJA implemented state and local tax (SALT) limit on an individual taxpayer's ability to take the itemized deduction for state and local taxes, California has just passed legislation which offers a work-around that will allow many Californians to mitigate the effects of the current $10,000 federal limitation on SALT deductions. On 7/16/2021, Governor Newsom signed into law AB-150, which provides a means by which certain pass-through entities (Qualified Entities) can make an election to pay California income tax (at the entity-level) on behalf of their owners, for which their consent must be given. The benefits yielded could be substantial for pass-through entity owners for which work-around makes sense. Curiously the IRS has approved these...

Although auto sales plunged at the start of the COVID-19 pandemic, they’ve since rebounded. In fact, some dealerships are reporting record sales in 2021. Problems remain — including supply bottlenecks. Also, your dealership may be more vulnerable to fraud. Factors such as employees working from home, new vendors and even booming sales, can put your business at risk. Here’s how to prevent fraud from cutting into profits. Focus on accounting Fraud prevention starts with strong internal controls. For example, good controls generally require a dealership’s accounting department to post transactions daily, including new and used vehicle sales, repair orders, invoice payments, payroll and cash receipts. By 1 p.m. on any given day, you should have access to real-time checkbook balances and other accounting information effective as of 5 p.m. the...

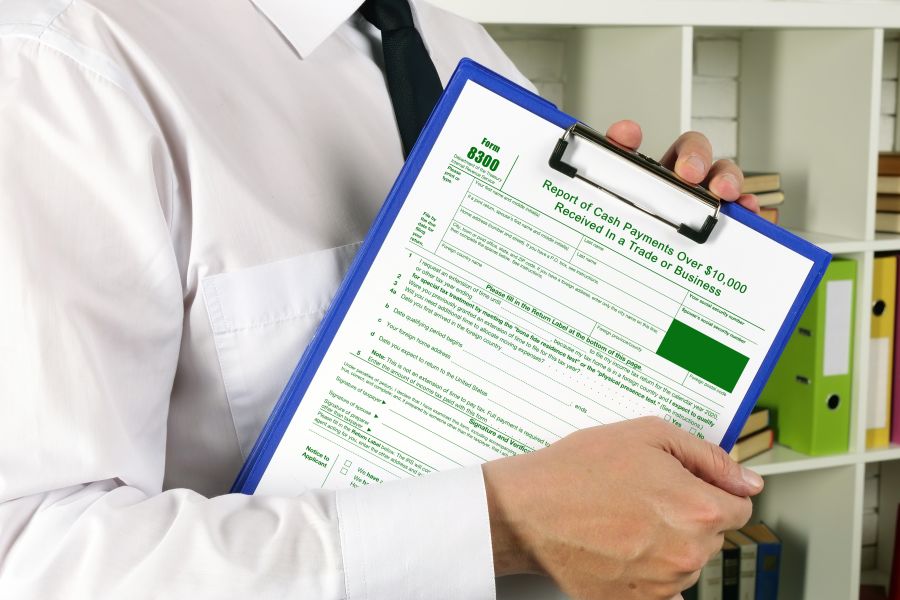

The Internal Revenue Service recently reminded businesses (in News Release 2021-47) of their responsibility to report large cash transactions via the filing of Form 8300, Report of Cash Payments Over $10,000, and encourages e-filing to help them file accurate, complete forms. Although many cash transactions are legitimate, information reported on Form 8300 can help stop those who evade taxes, profit from drug trading, engage in terrorist financing and conduct other criminal activities. The government can often trace money from these illegal activities through payments reported on complete, accurate forms. To help businesses prepare and file reports, the IRS created a video on How to Complete Form 8300 – Part I, Part II. The short video points out sections of Form 8300 for which the IRS commonly finds...