As reported via IR-2023-230 on 12/6/2023 As part of continuing efforts to combat dubious Employee Retention Tax Credit (ERTC) claims, the Internal Revenue Service is sending an initial round of more than 20,000 letters to taxpayers notifying them of disallowed ERTC claims. IRS is disallowing claims to entities that: did not exist, or did not have paid employees during the period of eligibility to prevent improper ERTC payments from being made to ineligible entities. The letters are being sent as the IRS continues increased scrutiny of ERTC claims in response to misleading marketing campaigns that have targeted small businesses and other organizations. The IRS mailing is the latest in an expanded compliance effort that includes a special withdrawal program for those with pending claims who realize they...

California AB 2280 established a new Unclaimed Property Voluntary Compliance Program that waives interest for taxpayers who voluntarily come into compliance with unclaimed property reporting requirements. The State Controller’s Office (SCO) has now opened the sign up process for businesses to apply for the program. Unclaimed Property Reporting Explained California businesses holding property belonging to others must file with the SCO to report unclaimed financial assets held by the entity for longer than the dormancy period applicable to the property in question (see “Unclaimed Property Explained” below). Failure to comply without reasonable cause Businesses that fail to comply with the unclaimed property reporting requirements, and do not have reasonable cause, are subject to interest assessed at the rate of 12% on the value of the unclaimed property. There exists...

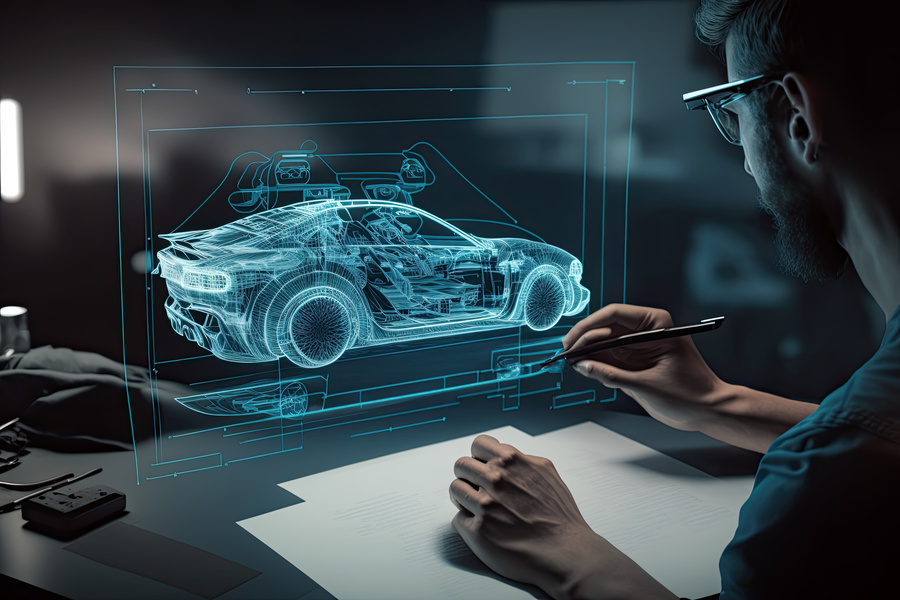

As posted to the AutoLine Network YouTube Channel on 9/11/2023 (Run Time 10 min, 13 sec) AutoLine's John McElroy interviews Caresoft's Han Ly at the International Motor/Mobility Show in Munich. Caresoft, a company that specializes in vehicle teardowns and benchmarking, provides insights into how Tesla designs its cars for modular assembly, notably how it eliminates fasteners and complexity. (This is Blog Post #1482) John McElroy has been called an influential thought leader in the automotive industry. He created “Autoline Daily,” the first industry webcast of industry news and analysis. He also hosts the Emmy Award-winning television program “Autoline This Week” and co-hosts “Autoline After Hours”, all of which can be found at www.autoline.tv....

As reported via IR-2023-193 on 10/19/2023 Special initiative aimed at helping businesses concerned about an ineligible claim amid aggressive marketing, scams As part of a larger effort to protect small businesses and organizations from scams, the Internal Revenue Service announced the details of a special withdrawal process to help those who filed an Employee Retention Tax Credit (ERTC) claim and are concerned about its accuracy. This new withdrawal option allows certain employers that filed an ERTC claim but have not yet received a refund to withdraw their submission and avoid future repayment, interest and penalties. Employers that submitted an ERTC claim that's still being processed can withdraw their claim and avoid the possibility of getting a refund for which they're ineligible. The IRS created the withdrawal option to help...

As reported via IR-2023-202 on 11/1/2023 IRS opens free Energy Credit Online tool for sellers of clean vehicles to register for time-of-sale reporting and dealer advance payments for the Clean Vehicle Credit The Internal Revenue Service announced today that sellers of clean vehicles can now register using the new IRS Energy Credits Online tool, available free from the IRS. Known as IRS Energy Credits Online or IRS ECO, this free electronic service is secure, accurate and requires no special software. Though available to any business of any size, IRS Energy Credit Online may be especially helpful to any small business that currently sells clean vehicles. The IRS’s new Energy Credits Online tool will allow dealers and sellers of clean vehicles to complete the entire process online and receive advance...

As appearing in IRS IR-2023-169 To protect taxpayers from scams, IRS orders immediate stop to new Employee Retention Tax Credit (ERTC) processing amid surge of questionable claims Concerns from tax pros, aggressive marketing to ineligible applicants highlights unacceptable risk to businesses and the tax system Moratorium on processing of new claims through year’s end will allow IRS to add more safeguards to prevent future abuse, protect businesses from predatory tactics; IRS working with Justice Department to pursue fraud fueled by aggressive marketing WASHINGTON – Amid rising concerns about a flood of improper Employee Retention Credit claims, the Internal Revenue Service today announced an immediate moratorium through at least the end of the year on processing new claims for the pandemic-era relief program to protect honest small business owners from...

As reported in IRS News Release IR-2023-157 The Internal Revenue Service announced that starting 1/1/2024, businesses are required to electronically file (e-file) Form 8300, Report of Cash Payments Over $10,000, instead of filing a paper return. This new requirement follows final regulations amending e-filing rules for information returns, including Forms 8300. Businesses that receive more than $10,000 in cash must report transactions to the U.S. government. Although many cash transactions are legitimate, information reported on Forms 8300 can help combat those who evade taxes, profit from the drug trade, engage in terrorist financing or conduct other criminal activities. The government can often trace money from these illegal activities through payments reported on Forms 8300 that are timely filed, complete and accurate. The new requirement for e-filing Forms 8300...

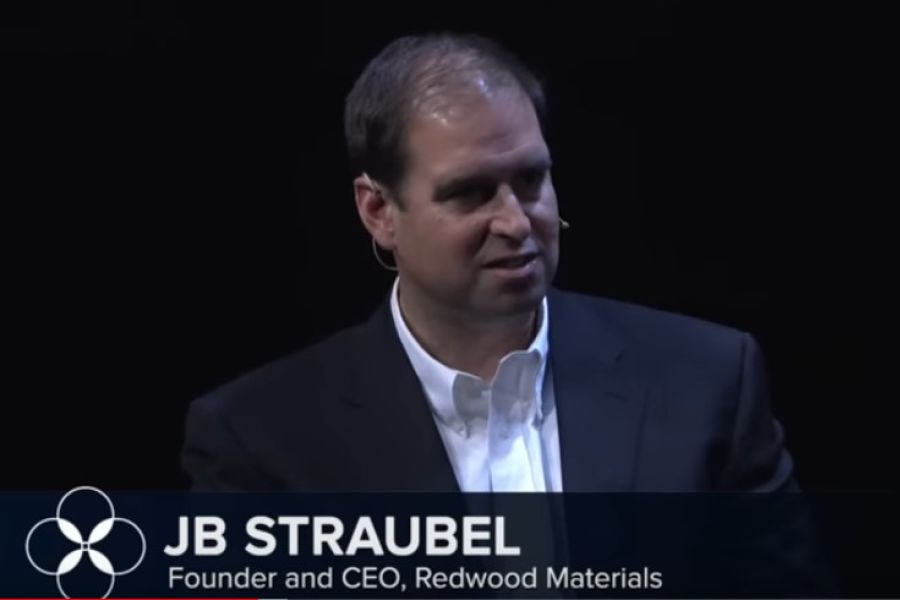

As posted to the Climate One YouTube page on 7/17/23 Run Time 58 minutes, 47 seconds (when beginning at Time Stamp 21:33) Climate One clip description: Demand for lithium ion batteries is expected to grow 500% by 2030, and the race for raw materials is on. Lithium mines around the world are opening or expanding, while children as young as six in the Congo carry sacks of cobalt-laced rocks on their backs for less than $2 a day. Recycling presents promising opportunities, yet before millions of batteries can be recycled, they have to be made in the first place. At the same time, advances in battery chemistry continue to be made, and it’s not hard to imagine a near future when batteries don’t require lithium or cobalt at...

As posted to the Engineering Explained YouTube Channel on 12/23/2022 (Run Time 11 min, 45 sec) Electric cars place unique challenges on tires, as a result of four key characteristics: weight, efficiency, noise, and torque. Thanks to asking Hankook's engineers an abundance of questions, John Fenske has got all the answers on how electric car tires can help EVs overcome these challenges. (This is Blog Post #1396) Jason Fenske is a graduated mechanical engineer with a passion for cars, and his goal is to help other people passionate about cars learn how they work. Check out his YouTube Channel here: www.youtube.com/@EngineeringExplained/about...

As posted to the AutoLine Network YouTube Channel on 4/8/2023 (Run Time 10 min, 25 sec) John McElroy presents his 2023 ranking of the top 12 automakers based on revenue, profits and several other factors. No editorializing . . . just the numbers. (This is Blog Post #1396) John McElroy has been called an influential thought leader in the automotive industry. He created “Autoline Daily,” the first industry webcast of industry news and analysis. He also hosts the Emmy Award-winning television program “Autoline This Week” and co-hosts “Autoline After Hours”, all of which can be found at www.autoline.tv....