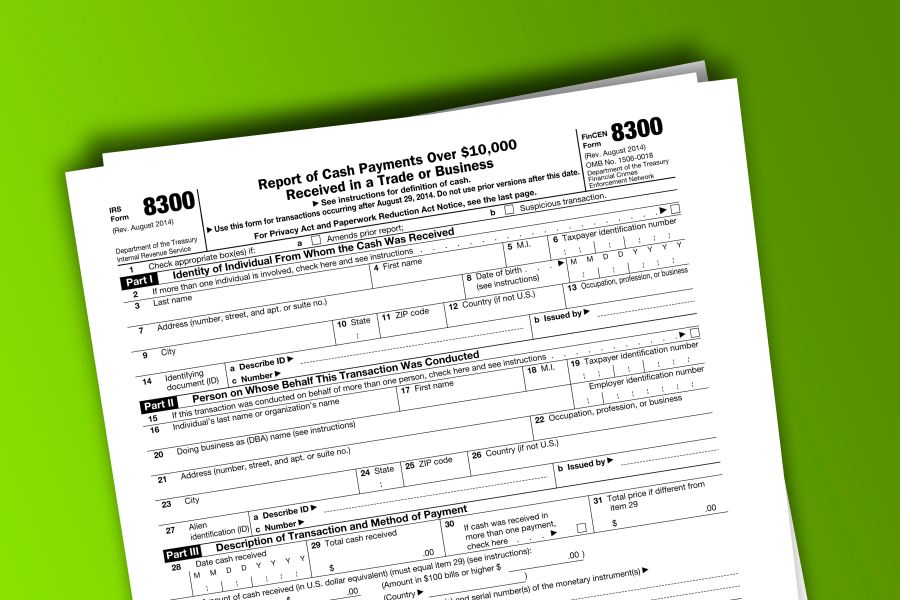

In a recent ruling, the U.S. Tax Court upheld over $118,000 in penalties against Dealers Auto Auction of Southwest LLC, a Phoenix-based car dealership, for failing to comply with federal cash transaction reporting requirements in 2016. The case, documented in TC Memo. 2025-38, serves as a stark reminder of the importance of adhering to IRS regulations for businesses handling large cash transactions. . Background: Cash Reporting Obligations Under Internal Revenue Code (IRC) §6050I, businesses that receive more than $10,000 in cash in a single transaction (or related transactions) are required to report the transaction to the IRS by filing Form 8300. This requirement aims to ensure transparency and combat financial crimes. For Dealers Auto Auction of Southwest LLC (Dealers Auto), which operates an automobile auction house in Arizona...