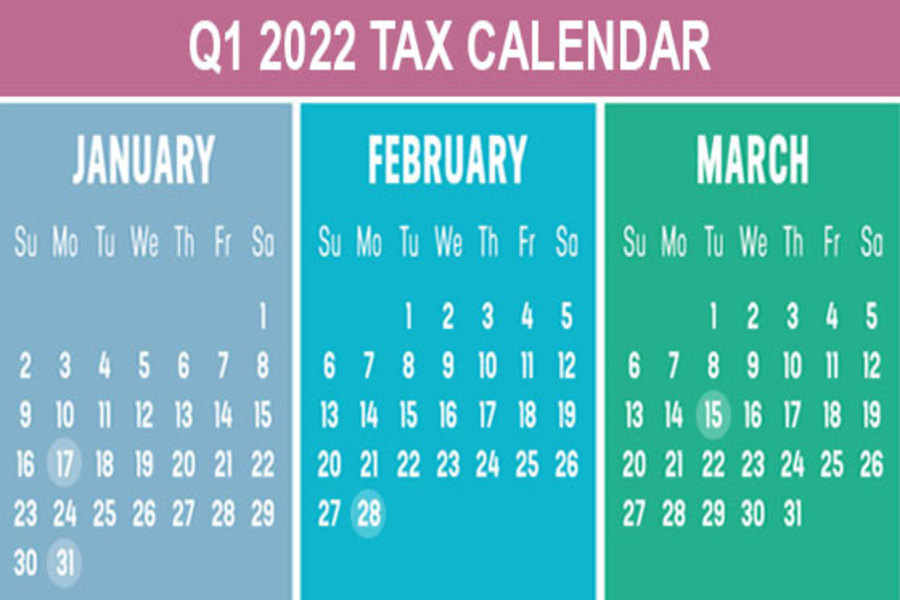

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January 17 (The usual deadline of January 15 is a Saturday) Pay the final installment of 2021 estimated tax. Farmers and fishermen: Pay estimated tax for 2021. January 31 File 2021 Forms W-2, “Wage and Tax Statement,” with the Social Security Administration and provide copies to your employees. Provide copies of 2021 Forms 1099-MISC, “Miscellaneous Income,” to recipients of income from your business where required. File 2021 Forms 1099-MISC, reporting nonemployee compensation payments...