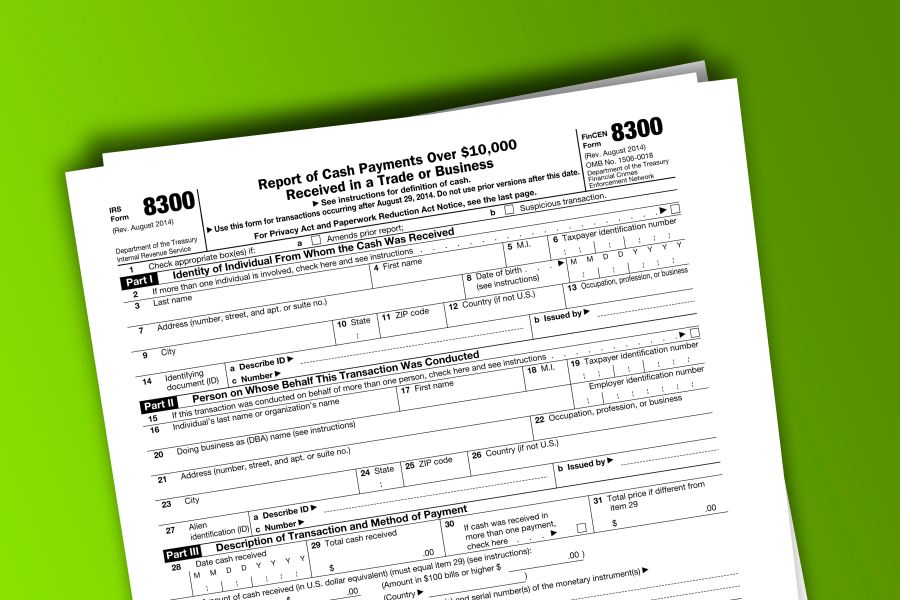

As reported in IRS News Release IR-2023-157 The Internal Revenue Service announced that starting 1/1/2024, businesses are required to electronically file (e-file) Form 8300, Report of Cash Payments Over $10,000, instead of filing a paper return. This new requirement follows final regulations amending e-filing rules for information returns, including Forms 8300. Businesses that receive more than $10,000 in cash must report transactions to the U.S. government. Although many cash transactions are legitimate, information reported on Forms 8300 can help combat those who evade taxes, profit from the drug trade, engage in terrorist financing or conduct other criminal activities. The government can often trace money from these illegal activities through payments reported on Forms 8300 that are timely filed, complete and accurate. The new requirement for e-filing Forms 8300...