As posted to the Munro Live YouTube Channel on 4/24/2024 (Run Time 18 min, 42 sec) Sandy Munro and Armin von Czarnowski demonstrate how steer-by-wire works and examine the components that make it possible in the Cybertruck. Steer-by-wire differs significantly from a normal steering system in that there is no mechanical linkage between the steering wheel and the front wheels. While it may appear perilous to you, it is worth noting that Tesla vehicles are equipped with numerous redundancies. (This is Blog Post #1575) Sandy Munro is an automotive engineer who specializes in machine tools and manufacturing. He joined the Ford Motor Company in 1978 and then started his own consulting company, Munro & Associates, which specializes in lean design, tearing down automotive products to study and suggest improvements and...

According to the Treasury, the US government has provided auto dealers with >$580 million in advance payments for consumer electric vehicle (EV) tax credits since 1/1/2024. Before 2024, American car purchasers were only eligible for the new electric vehicle (EV) credit of up to $7,500 or the $4,000 credit for used EVs when they submitted their tax returns in the subsequent year. Commencing on January 1, consumers have the ability to transfer the credits to a car dealer during the transaction, so reducing the purchase price. This year, the IRS has received almost 100,000 reports on the sale of electric vehicles. A total of 85,000 time of sale tax reports were filed for new electric vehicles (EVs), and more than 90% of these reports included requests for advance...

The IRS' recent declaration of a rigorous enforcement against the utilization of corporate jets has attracted widespread attention, as the Biden administration persists in intensifying its examination of affluent individuals and major corporations with intricate tax arrangements. Zeinat Zughayer, a tax controversy manager at Baker Tilly, provided information on the driving force behind the recent wave of audits and the extent of their coverage. The IRS recently declared its intention to commence several audits targeting the apportionment of corporate aircraft usage between business and personal purposes by executives, partners, shareholders, and other individuals for tax-related matters. According to the IRS, the level of personal usage has an effect on the eligibility for specific company deductions. "Utilizing the company jet for personal travel usually leads to the...

As reported in IR-2024-46 Using Inflation Reduction Act funding and as part of ongoing efforts to improve tax compliance in high-income categories, the Internal Revenue Service announced on 2/21/24 plans to begin dozens of audits on business aircraft involving personal use. The audits will be focused on aircraft usage by large corporations, large partnerships and high-income taxpayers and whether for tax purposes the use of jets is being properly allocated between business and personal reasons. The IRS will be using advanced analytics and resources from the Inflation Reduction Act to more closely examine this area, which has not been closely scrutinized during the past decade as agency resources fell sharply. The number of audits related to aircraft usage could increase in the future following initial results and as...

The qualified business income (QBI) deduction is available to eligible businesses through 2025. After that, it’s scheduled to disappear. So if you’re eligible, you want to make the most of the deduction while it’s still on the books because it can potentially be a big tax saver. Deduction basics The QBI deduction is written off at the owner level. It can be up to 20% of: QBI earned from a sole proprietorship or single-member LLC that’s treated as a sole proprietorship for tax purposes, plus QBI from a pass-through entity, meaning a partnership, LLC that’s treated as a partnership for tax purposes or S corporation. How is QBI defined? It’s qualified income and gains from an eligible business, reduced by related deductions. QBI is reduced by: 1) deductible...

We are finding that, all too often, taxpayers that make Employee Retention Tax Credit (ERTC) claims by engaging a so-called “ERTC Mill” are never told of their responsibility to amend their applicable prior year federal income tax return(s), and are shocked to learn that they owe additional taxes, penalties and interest. In order to offset their wage expense for the amount of the credit claimed, taxpayers who file an amended Form 941-X to claim an ERTC refund must simultaneously file an amended income tax return(s) for the tax year(s) in which the ERTC-eligible wages were paid. Because of the resulting lower salary expense, this results in a higher tax burden for taxpayers with sizable ERTC refunds. Reasonable Cause Penalty Relief To the extent an ERTC was retroactively claimed,...

Although financial statement fraud is the least common form of occupational theft (9% of incidents), it costs organizations the most in financial losses, according to the Association of Certified Fraud Examiners. Businesses defrauded by financial statement schemes had median losses of $593,000. Early revenue recognition, which distorts profits and can artificially boost a business’s financial profile, is popular among financial statement fraud perpetrators. To comply with Generally Accepted Accounting Principles and preserve your company’s reputation, you must prevent such activities on your watch. It’s also important to be able to detect them in the financial statements of business partners, including acquisition targets and customers applying for credit. Schemes and warning signs Owners, executives and others with access to financial statements might recognize revenue improperly by delivering products early,...

As part of the SECURE 2.0 law, there’s a new benefit option for employees facing emergencies. It’s called a pension-linked emergency savings account (PLESA) and the provision authorizing it became effective for plan years beginning January 1, 2024. The IRS recently released guidance about the accounts (in Notice 2024-22) and the U.S. Department of Labor (DOL) published some frequently asked questions to help employers, plan sponsors, participants and others understand them. PLESA basics The DOL defines PLESAs as “short-term savings accounts established and maintained within a defined contribution plan.” Employers with 401(k), 403(b) and 457(b) plans can opt to offer PLESAs to non-highly compensated employees. For 2024, a participant who earned $150,000 or more in 2023 is a highly compensated employee. Here are some more details of this...

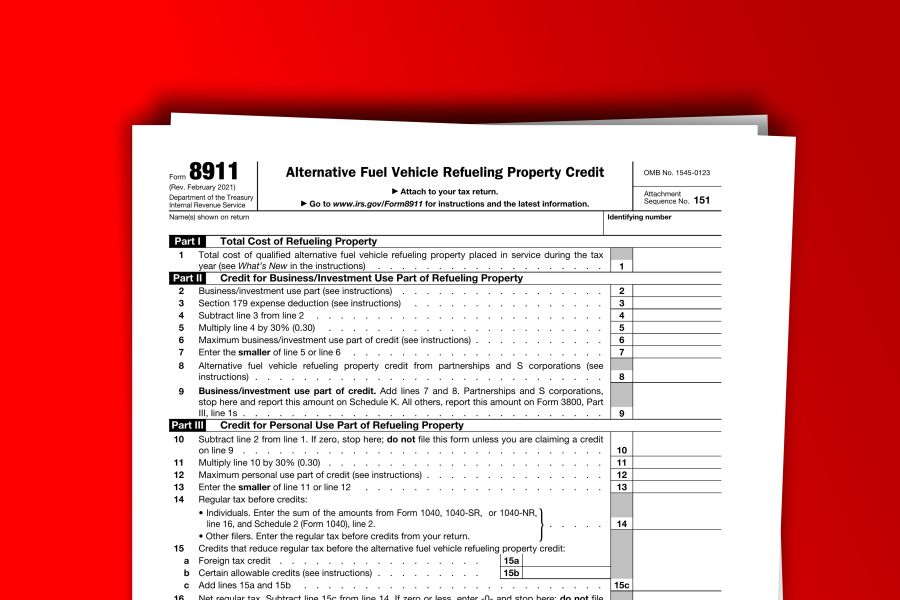

As reported via IR-2024-16 on 1/19/2024 The Internal Revenue Service and the Department of the Treasury today issued Notice 2024-20 to provide guidance on eligible census tracts for the qualified alternative fuel vehicle refueling property credit (the tax credit applicable to the installation of EV chargers) and to announce the intent to propose regulations for the credit. The Inflation Reduction Act amended the credit for qualified alternative fuel vehicle refueling property. The changes apply to qualified alternative fuel vehicle refueling property placed in service after December 31, 2022 and before January 1, 2033. Business vs Non-Business Property Property Not Subject to Depreciation The credit amount for property not subject to depreciation is 30% of the cost of the qualified property placed in service during the tax year. The credit is...

As the Financial Crimes Enforcement Network (FinCEN) opens its beneficial ownership information (BOI) reporting portal, its BOI webpage, reflects a fraud alert for individuals and entities who may be subject to beneficial ownership information (BOI) reporting. According to the FinCEN fraud alert, individuals and entities that may be subject to the beneficial ownership information (BOI) reporting requirements have been receiving fraudulent correspondence, via email or traditional mail, that appears as though it came from FinCEN. In some instances, the fraudulent correspondence may be titled "Important Compliance Notice" and ask the recipient to click on a URL or to scan a QR code. Be advised that e-mails or letters such as this are fraudulent, according to the alert. FinCEN cautions individuals that it does not send unsolicited requests for information,...